Investment Banking, valuation and M&A

Подождите немного. Документ загружается.

P1: ABC/ABC P2:c/d QC:e/f T1:g

c05 JWBT063-Rosenbaum March 18, 2009 15:37 Printer Name: Hamilton

LBO Analysis

215

STEP IV. COMPLETE THE POST-LBO MODEL

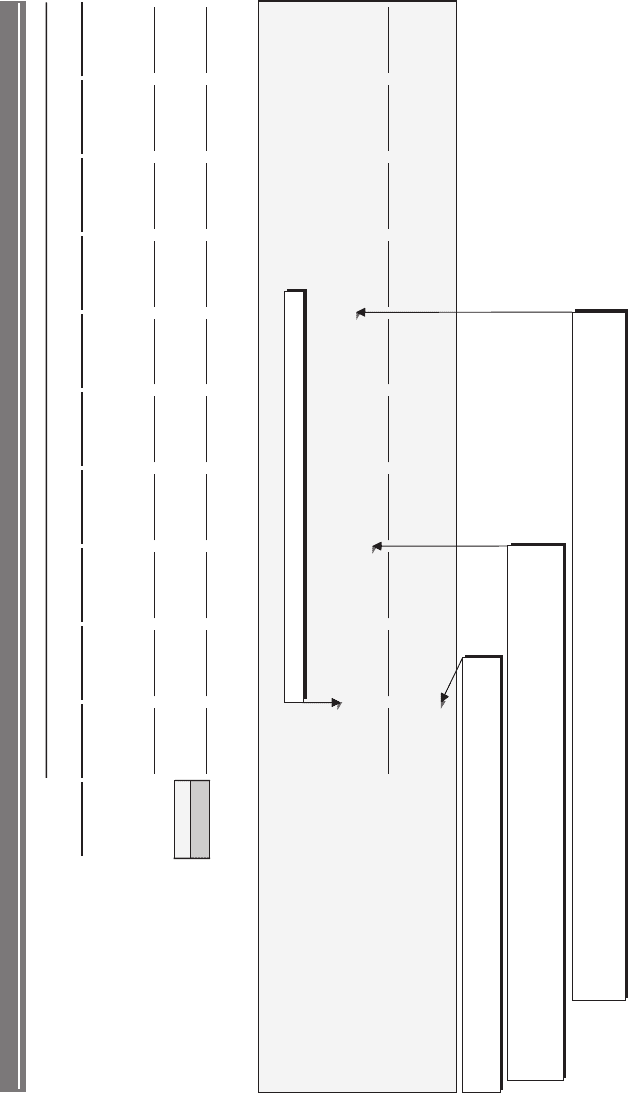

EXHIBIT 5.23 Steps to Complete the Post-LBO Model

Step IV(a): Build Debt Schedule

Step IV(b): Complete Pro Forma Income Statement from EBIT to Net Income

Step IV(c): Complete Pro Forma Balance Sheet

Step IV(d): Complete Pro Forma Cash Flow Statement

Step IV(a): Build Debt Schedule

The debt schedule is an integral component of the LBO model, serving to layer

in the pro forma effects of the LBO financing structure on the target’s financial

statements.

15

Specifically, the debt schedule enables the banker to:

complete the pro forma income statement from EBIT to net income

complete the pro forma long-term liabilities and shareholders’ equity sections of

the balance sheet

complete the pro forma financing activities section of the cash flow statement

As shown in Exhibit 5.27, the debt schedule applies free cash flow to make

mandatory and optional debt repayments, thereby calculating the annual beginning

and ending balances for each debt tranche. The debt repayment amounts are linked

to the financing activities section of the cash flow statement and the ending debt

balances are linked to the balance sheet. The debt schedule is also used to calculate

the annual interest expense for the individual debt instruments, which is linked to

the income statement.

The debt schedule is typically constructed in accordance with the security and

seniority of the loans, securities, and other debt instruments in the capital structure

(i.e., beginning with the revolver, followed by term loan tranches, and bonds). As

detailed in the following pages, we began the construction of ValueCo’s debt sched-

ule by entering the forward LIBOR curve, followed by the calculation of annual

projected cash available for debt repayment (free cash flow). We then entered the

key terms for each individual debt instrument in the financing structure (i.e., size,

term, coupon, and mandatory repayments/amortization schedule, if any).

Forward LIBOR Curve For floating-rate debt instruments, such as revolving credit

facilities and term loans, interest rates are typically based on LIBOR

16

plus a fixed

spread. Therefore, to calculate their projected annual interest expense, the banker

15

In lieu of a debt schedule, some LBO model templates use formulas in the appropriate cells in

the financing activities section of the cash flow statement and the interest expense line item(s)

of the income statement to perform the same functions.

16

3-month LIBOR is generally used.

P1: ABC/ABC P2:c/d QC:e/f T1:g

c05 JWBT063-Rosenbaum March 18, 2009 15:37 Printer Name: Hamilton

216 LEVERAGED BUYOUTS

must first enter future LIBOR estimates for each year of the projection period. LIBOR

for future years is typically sourced from the Forward LIBOR Curve provided by

Bloomberg.

17

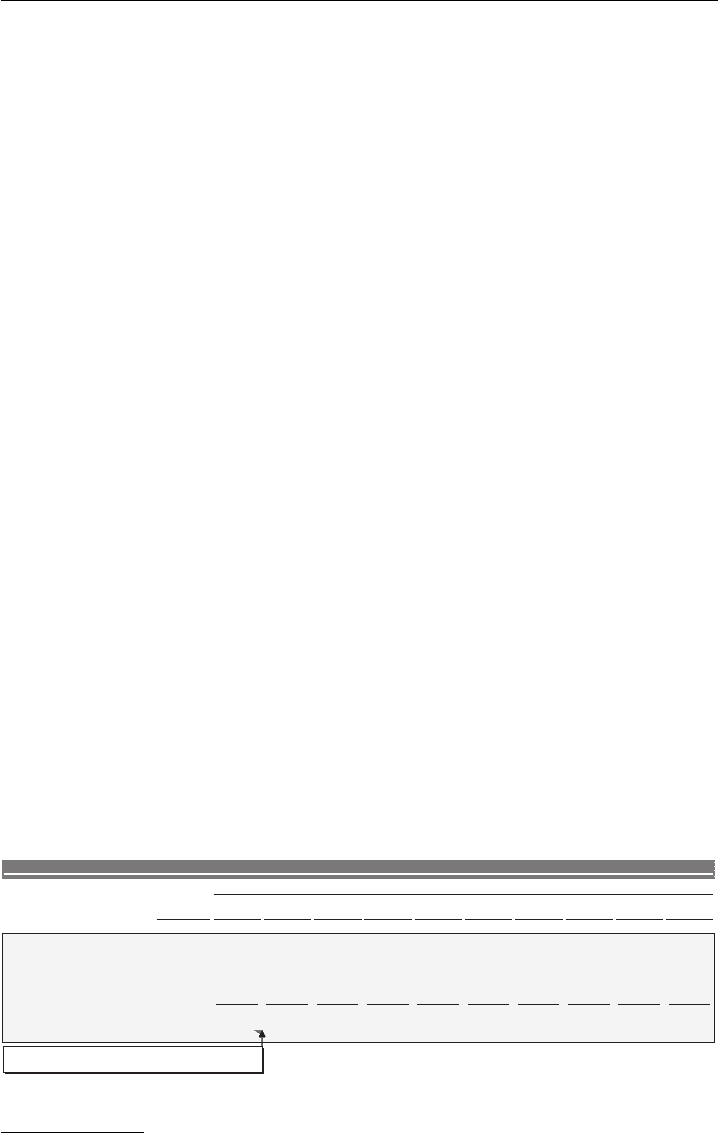

EXHIBIT 5.24 Forward LIBOR Curve

($ in millions, fiscal year ending December 31)

Projection Period

Pro forma Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

2008

2009 2010

2011 2012

2013 2014 2015

2016 2017 2018

Forward LIBOR Curve

5.10%4.85%4.80%4.35%4.00%3.60%3.30%3.15%3.00%3.00% 5.25%

Debt Schedule

As shown in the forward LIBOR curve line item in Exhibit 5.24, LIBOR is

expected to increase incrementally throughout the projection period from 300 bps

in 2009E to 525 bps by 2018E.

18

The pricing spreads for the revolver and TLB are

added to the forward LIBOR in each year of the projection period to calculate their

annual interest rates. For example, the 2009E interest rate for ValueCo’s revolver,

which is priced at L+325 bps, is 6.25% (300 bps LIBOR + 325 bps spread, see

Exhibit 5.26).

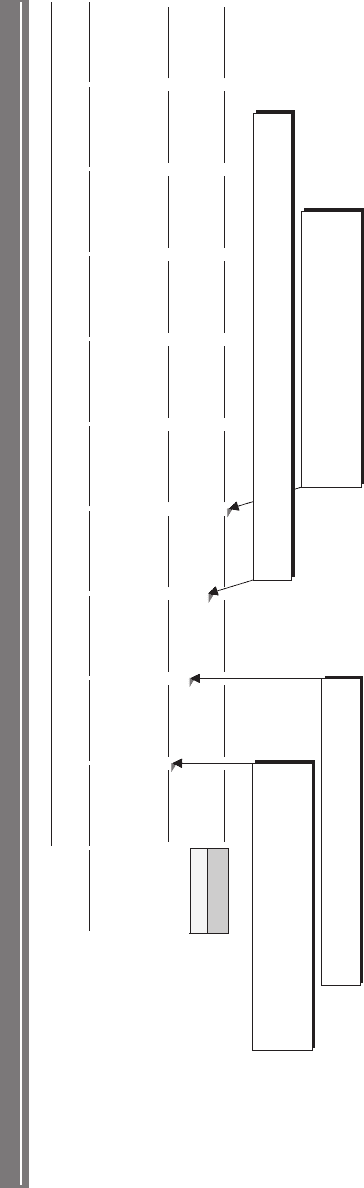

Cash Available for Debt Repayment (Free Cash Flow) The annual projected cash

available for debt repayment is the sum of the cash flows provided by operating and

investing activities on the cash flow statement. It is calculated in a section beneath

the forward LIBOR curve inputs. For each year in the projection period, this amount

is first used to make mandatory debt repayments on the term loan tranches.

19

The

remaining cash flow is used to make optional debt repayments, as calculated in the

cash available for optional debt repayment line item (see Exhibit 5.25).

In addition to internally generated free cash flow, existing cash from the balance

sheet may be used (“swept”) to make incremental debt repayments (see cash from

balance sheet line item in Exhibit 5.25). In ValueCo’s case, however, there is no cash

on the pro forma balance sheet at closing as it is used as part of the transaction

funding. In the event the post-LBO balance sheet has a cash balance, the banker may

choose to keep a constant minimum level of cash on the balance sheet throughout

the projection period by inputting a dollar amount under the “MinCash” heading

(see Exhibit 5.25).

As shown in Exhibit 5.25, pro forma for the LBO, ValueCo generates $65.3

million of cash flow from operating activities in 2009E. Netting out ($21.6) million

of cash flow from investing activities results in cash available for debt repayment of

$43.7 million. After satisfying the $4.5 million mandatory amortization of the TLB,

ValueCo has $39.2 million of cash available for optional debt repayment.

17

Bloomberg function: “FWCV,” select “US” (if pricing is based on U.S. LIBOR).

18

Following the onset of the subprime mortgage crisis and the ensuing credit crunch, and the

resulting rate cuts by the Federal Reserve, investors have insisted on “LIBOR floors” in many

new bank deals. A LIBOR floor guarantees a minimum coupon for investors regardless of

how low LIBOR falls. For example, a term loan priced at L+350 bps with a LIBOR floor of

325 bps will have a cost of capital of 6.75% even if the prevailing LIBOR is lower than 325

bps.

19

Mandatory repayments are determined in accordance with each debt instrument’s amorti-

zation schedule.

P1: ABC/ABC P2:c/d QC:e/f T1:g

c05 JWBT063-Rosenbaum March 18, 2009 15:37 Printer Name: Hamilton

EXHIBIT 5.25

Cash Available for Debt Repayment (Free Cash Flow)

($ in millions, fiscal year ending December 31)

Projection Period

Pro forma Year 1 Year 2 Year 3

Year 4 Year 5 Year 6 Year 7

Year 8 Year 9 Year 10

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

Forward LIBOR Curve

5.10%

4.85%

4.80%

4.35%

4.00%

3.60%

3.30%

3.15%

3.00%

3.00%

5.25%

$65.3

Cash Flow from Operating Activities

$74.9

$83.4

$90.2

$96.3

$103.2

$110.7

$117.1

$122.9

$128.8

Cash Flow from Investing Activities

(21.6)

(22.9)

(23.8)

(24.5)

(25.3)

(26.0)

(26.8)

(27.6)

(29.3)

(28.4)

Cash Available for Debt Repayment

$43.7 $52.0

$59.6

$65.7

$71.1

$77.2

$83.9

$89.5

$94.4

$99.6

Total Mandatory Repayments

MinCash

(4.5) (4.5) (4.5) (4.5)

(4.5) (4.5)

(4.5) -

- -

Cash From Balance Sheet

-

-

-

-

-

-

-

3.2

-

92.7

187.2

$39.2

Cash Available for Optional Debt Repayment

$47.5

$55.1

$61.2

$66.6

$72.7

$79.4

$92.7

$187.2

$286.7

Debt Schedule

= Cash Flow from Operating Activiites

2009

+

Cash Flow from Financing Activities

2009

= $65.3 million + ($21.6) million

= Mandatory Repayments on the Term Loan B,

calculcated as 1% x $450.0 million

= Cash Flow for Debt Repayment

2012

-

Term Loan B Mandatory Repayment

2012

= $65.7 million + ($4.5) million

= IF (Cash Balance toggle = 1, then sweep cash from the Balance Sheet

less the Minimum Cash Balance, otherwise display 0)

217

P1: ABC/ABC P2:c/d QC:e/f T1:g

c05 JWBT063-Rosenbaum March 18, 2009 15:37 Printer Name: Hamilton

218 LEVERAGED BUYOUTS

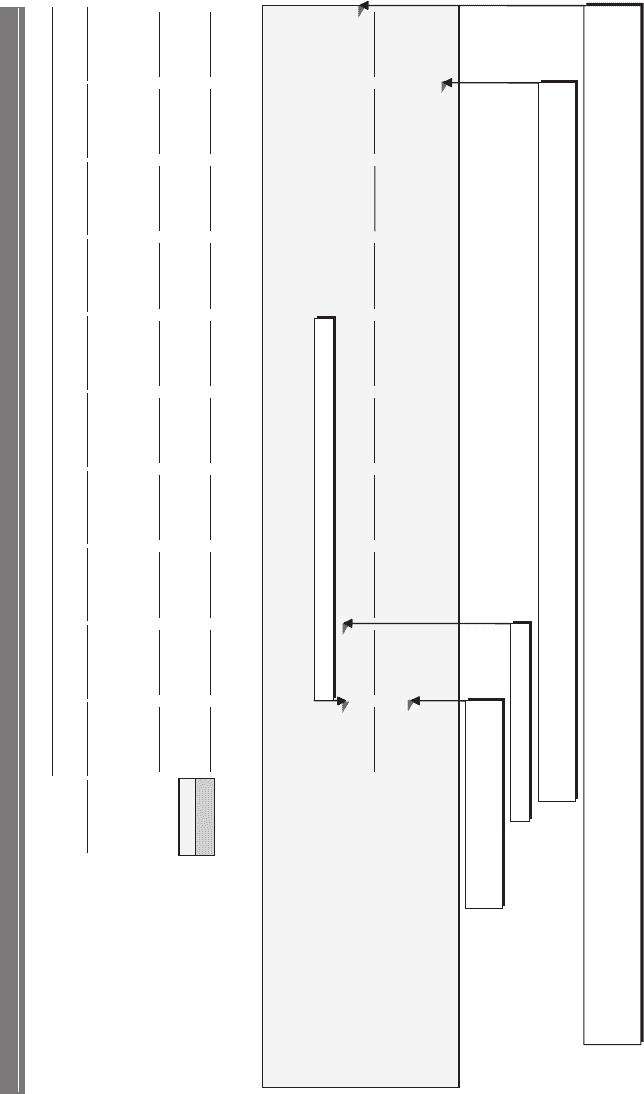

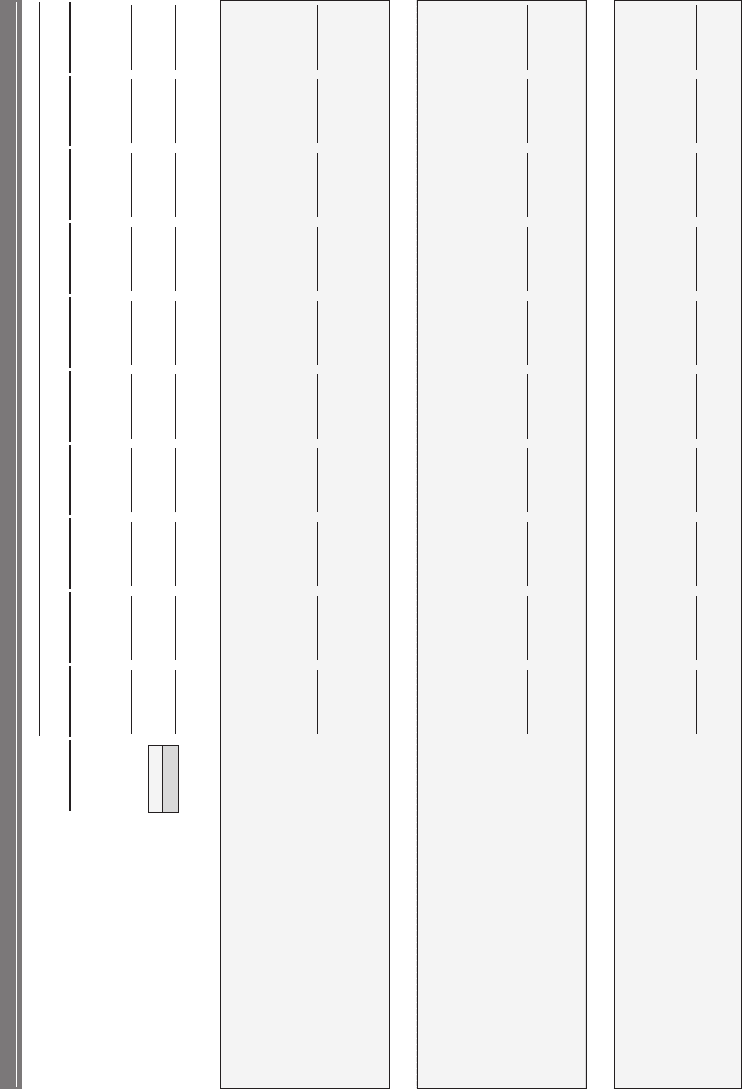

Revolving Credit Facility In the “Revolving Credit Facility” section of the debt

schedule, the banker inputs the spread, term, and commitment fee associated with

the facility (see Exhibit 5.26). The facility’s size is linked from an assumptions

page where the financing structure is entered (see Exhibits 5.14 and 5.54) and the

beginning balance line item for the first year of the projection period is linked from

the balance sheet. If no revolver draw is contemplated as part of the LBO financing

structure, then the beginning balance is zero.

The revolver’s drawdown/(repayment) line item feeds from the cash available

for optional debt repayment line item at the top of the debt schedule. In the event the

cash available for optional debt repayment amount is negative in any year (e.g., in a

downside case), a revolver draw (or use of cash on the balance sheet, if applicable)

is required. In the following period, the outstanding revolver debt is then repaid first

from any positive cash available for optional debt repayment (i.e., once mandatory

repayments are satisfied).

In connection with the ValueCo LBO, we contemplated a $100 million revolver,

which is priced at L+325 bps with a term of six years. The revolver is assumed to be

undrawn at the close of the transaction and remains undrawn throughout the pro-

jection period. Therefore, no interest expense is incurred. ValueCo, however, must

pay an annual commitment fee of 50 bps on the undrawn portion of the revolver,

translating into an expense of $500,000 ($100 million × 0.50%) per year (see

Exhibit 5.26).

20

This amount is included in interest expense on the income statement.

Term Loan Facility In the “Term Loan Facility” section of the debt schedule, the

banker inputs the spread, term, and mandatory repayment schedule associated with

the facility (see Exhibit 5.27). The facility’s size is linked from the sources and uses

of funds on the transaction summary page (see Exhibit 5.46). For the ValueCo LBO,

we contemplated a $450 million TLB with a coupon of L+350 bps and a term of

seven years.

Mandatory Repayments (Amortization) Unlike a revolving credit facility, which

only requires repayment at the maturity date of all the outstanding advances, a term

loan facility is fully funded at close and has a set amortization schedule as defined

in the corresponding credit agreement. While amortization schedules vary per term

loan tranche, the standard for TLBs is 1% amortization per year on the principal

amount of the loan with a bullet payment of the loan balance at maturity.

21

As noted in Exhibit 5.27 under the repayment schedule line item, ValueCo’s new

TLB requires an annual 1% amortization payment equating to $4.5 million ($450

million x 1%).

Optional Repayments A typical LBO model employs a “100% cash flow sweep”

that assumes all cash generated by the target after making mandatory debt repay-

ments is applied to the optional repayment of outstanding prepayable debt (typically

20

To the extent the revolver is used, the commitment expense will decline and ValueCo will

be charged interest on the amount of the revolver draw at L+325 bps.

21

Credit agreements typically also have a provision requiring the borrower to prepay term

loans in an amount equal to a specified percentage (and definition) of excess cash flow and in

the event of specified asset sales and issuances of certain debt or equity.

P1: ABC/ABC P2:c/d QC:e/f T1:g

c05 JWBT063-Rosenbaum March 18, 2009 15:37 Printer Name: Hamilton

EXHIBIT 5.26

Revolving Credit Facility Section of Debt Schedule

Projection Period

Pro forma Year 1 Year 2 Year 3

Year 4 Year 5 Year 6 Year 7

Year 8 Year 9 Year 10

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

Forward LIBOR Curve

5.10%

4.85%

4.80%

4.35%

4.00%

3.60%

3.30%

3.15%

3.00%

3.00%

5.25%

$65.3

Cash Flow from Operating Activities

$74.9

$83.4

$90.2

$96.3

$103.2

$110.7

$117.1

$122.9

$128.8

Cash Flow from Investing Activities

(21.6)

(22.9)

(23.8)

(24.5)

(25.3)

(26.0)

(26.8)

(27.6)

(29.3)

(28.4)

Cash Available for Debt Repayment

$43.7 $52.0

$59.6

$65.7

$71.1

$77.2

$83.9

$89.5

$94.4

$99.6

Total Mandatory Repayments

MinCash

(4.5) (4.5) (4.5) (4.5)

(4.5)

(4.5)

(4.5)

-

-

-

Cash from Balance Sheet

-

-

-

-

-

-

-

3.2

-

92.7

187.2

$39.2

Cash Available for Optional Debt Repayment

$47.5

$55.1

$61.2

$66.6

$72.7

$79.4

$92.7

$187.2

$286.7

Revolving Credit Facility

$100.0

Revolving Credit Facility Size

Spread

3.250%

Term

6 years

Commitment Fee on Unused Portion

0.50%

Beginning Balance

- - -

- - - -

-

-

-

Drawdown / (Repayment)

-

-

-

-

-

-

-

-

-

-

Ending Balance

-

- -

-

-

-

-

-

-

-

Interest Rate

6.25% 6.40%

6.55%

6.85%

7.25%

7.60%

8.05%

8.10%

8.35%

8.50%

Interest Expense

- - - -

- - - -

-

-

0.5

Commitment Fee

0.5

0.5

0.5

0.5

0.5

0.5

0.5

0.5

0.5

= Ending Revolver Balance from Pro Forma 2008 Balance Sheet

= LIBOR

2009

+ Spread on Revolver

= 3.00% + 3.25%

= IF (Cash Available for Optional Debt Repayment

2018

> 0, then sweep the negative value of the minimum of (Cash Available for Optional Debt Repayment

2018

vs.

the Beginning Balance

2017

), otherwise sweep the negative value of the minimum of (Cash Available for Optional Debt Repayment

2018

vs. 0))

= IF (Cash Available for Optional Debt Repayment

2018

> 0, -MIN(Cash Available for Optional Debt Repayment

2018

, $0.0), -MIN(Cash Available for Optional Debt Repayment

2018

, 0))

= Ending Balance from prior year

= Commitment Fee on Unused Portion x (Revolver Capacity - (Average of Beginning Balance

2016

and Ending Balance

2017

))

= 0.50% x $100.0 million

($ in millions, fiscal year ending December 31)

Debt Schedule

219

P1: ABC/ABC P2:c/d QC:e/f T1:g

c05 JWBT063-Rosenbaum March 18, 2009 15:37 Printer Name: Hamilton

EXHIBIT 5.27

Term Loan Facility Section of Debt Schedule

($ in millions, fiscal year ending December 31)

Projection Period

Pro forma Year 1 Year 2 Year 3

Year 4 Year 5 Year 6 Year 7

Year 8 Year 9 Year 10

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

Forward LIBOR Curve

5.10%

4.85%

4.80%

4.35%

4.00%

3.60%

3.30%

3.15%

3.00%

3.00%

5.25%

3.56$

Cash Flow from Operating Activities

$74.9 $83.4 $90.2 $96.3

$103.2 $110.7 $117.1 $122.9

$128.8

Cash Flow from Investing Activities

(21.6)

(22.9)

(23.8)

(24.5)

(25.3)

(26.0)

(26.8)

(27.6)

(28.4)

(29.3)

Cash Available for Debt Repayment

$43.7 $52.0 $59.6 $65.7

$71.1 $77.2 $83.9 $89.5

$94.4 $99.6

Total Mandatory Repayments

MinCash

(4.5) (4.5) (4.5) (4.5)

(4.5) (4.5) (4.5) -

-

-

Cash from Balance Sheet

-

-

-

-

-

-

-

-

3.2

92.7

187.2

$39.2

Cash Available for Optional Debt Repayment

$47.5 $55.1 $61.2

$66.6 $72.7 $79.4 $92.7

$187.2 $286.7

Term Loan B Facility

$450.0

Size

Spread

3.500%

Term

7 years

Repayment Schedule

1.0%

per Annum, Bullet at Maturity

$450.0

Beginning Balance

$406.3 $354.2 $294.6 $228.9

$157.9 $80.7

-

--

Mandatory Repayments

(4.5)

(4.5)

(4.5)

(4.5) (4.5)

(4.5)

(4.5) -

--

Optional Repayments

(47.5)

(39.2)

(55.1)

(61.2)

(66.6)

(76.2)

(72.7)

-

-

-

$406.3

Ending Balance

$354.2 $294.6 $228.9

$157.9 $80.7

-

-

-

-

Interest Rate

6.50% 6.65% 6.80% 7.10%

7.50% 7.85% 8.30% 8.35%

8.60% 8.75%

27.8

Expense

Interest

25.3 22.1 18.6

14.5 9.4 3.3 -

-

-

Debt Schedule

= Ending Term Loan B Balance from Pro Forma 2008 Balance Sheet

= The negative of the minimum of (Cash Flow Available for Optional Debt Repayment

2011

vs. Beginning Balance

2011

+ Mandatory Amortization

2011

)

= -MIN($55.1 : $354.2 million + ($4.5) million)

= IF (Beginning Balance

2014

is greater than 0 and greater than 1% of the principal amount,

then subtract 1% Mandatory Amortization on the principal amount of the Term Loan B, otherwise display $0.0)

= IF ($157.9 million > 0 and > 1% x $450.0, then 1% x $450.0 million, otherwise $0.0)

= Interest Rate

2008

x Average(Beginning Balance

2009

: Ending Balance

2009

)

= 6.50% x Average of $450.0 million and $406.3 million

220

P1: ABC/ABC P2:c/d QC:e/f T1:g

c05 JWBT063-Rosenbaum March 18, 2009 15:37 Printer Name: Hamilton

LBO Analysis

221

bank debt). For modeling purposes, bank debt is generally repaid in the following

order: revolver balance, term loan A, term loan B, etc.

22

From a credit risk management perspective, ideally the target generates sufficient

cumulative free cash flow during the projection period to repay the term loan(s)

within their defined maturities. In some cases, however, the borrower may not be

expected to repay the entire term loan balance within the proposed tenor and will

instead face refinancing risk as the debt matures.

As shown in Exhibit 5.27, in 2009E, ValueCo is projected to generate cash avail-

able for debt repayment of $43.7 million. Following the mandatory TLB principal

repayment of $4.5 million, ValueCo has $39.2 million of excess free cash flow re-

maining. These funds are used to make optional debt repayments on the TLB, which

is prepayable without penalty. Hence, the beginning year balance of $450 million is

reduced to an ending balance of $406.3 million following the combined mandatory

and optional debt repayments.

Interest Expense The banker typically employs an average interest expense ap-

proach in determining annual interest expense in an LBO model. This methodology

accounts for the fact that bank debt is repaid throughout the year rather than at the

beginning or end of the year. Annual average interest expense for each debt tranche

is calculated by multiplying the average of the beginning and ending debt balances

in a given year by its corresponding interest rate.

As shown in Exhibit 5.27, in 2009E, ValueCo’s TLB has a beginning balance of

$450 million and ending balance of $406.3 million. Using the average debt approach,

this implies interest expense of $27.8 million for the TLB in 2009E (($450 million +

$406.3 million)/2) x 6.5%). The $27.8 million of interest expense is linked from the

debt schedule to the income statement under the corresponding line item for TLB

interest expense.

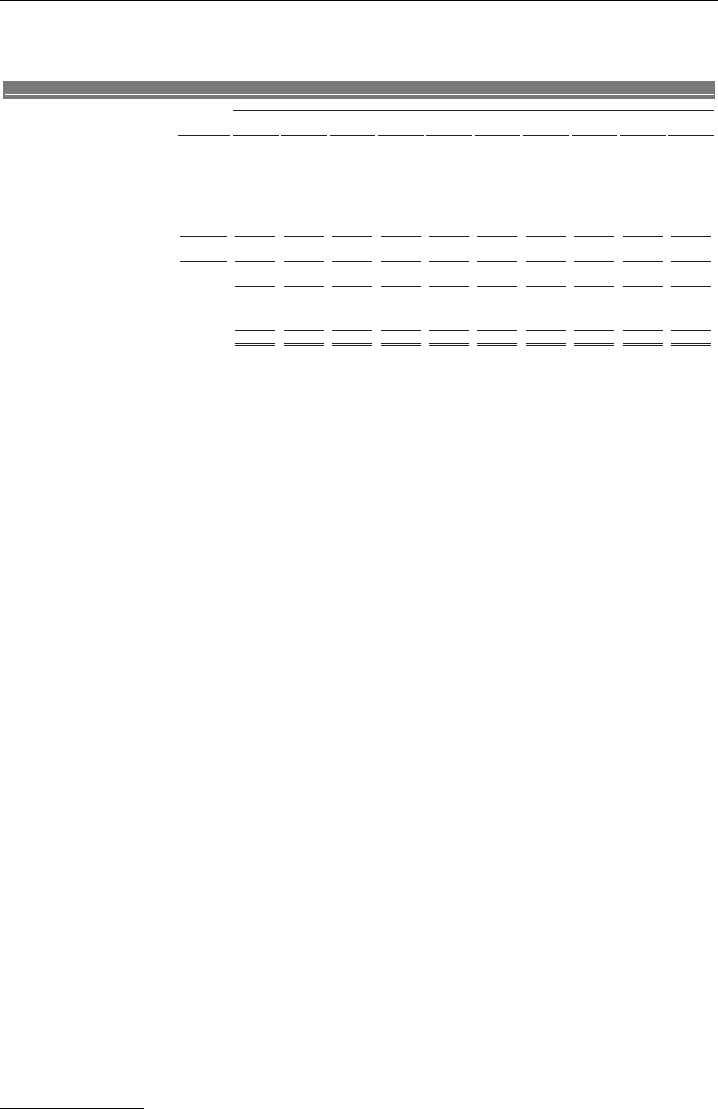

Senior Subordinated Notes In the “Senior Subordinated Notes” section of the debt

schedule, the banker inputs the coupon and term associated with the security (see

Exhibit 5.28). As with the TLB, the principal amount of the notes is linked from the

EXHIBIT 5.28

Senior Subordinated Notes Section of Debt Schedule

($ in millions, fiscal year ending December 31)

Projection Period

Pro forma Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

2008

2009 2010

2011

2012 2013

2014

2015 2016 2017 2018

Senior Subordinated Notes

$300.0Size

Coupon

10.000%

Term 10 years

$300.0Beginning Balance $300.0 $300.0 $300.0 $300.0 $300.0 $300.0 $300.0 $300.0 $300.0

Repayment

- - -

-

- - -

-

- -

$300.0Ending Balance $300.0 $300.0 $300.0 $300.0 $300.0 $300.0 $300.0 $300.0 $300.0

30.0ExpenseInterest 30.0 30.0 30.0 30.0 30.0 30.0 30.0 30.0 30.0

Debt Schedule

= Coupon on Senior Subordinated Notes x Principal Amount

= 10.0% x $300.0

22

Some credit agreements give credit to the borrower for voluntary repayments on a go-

forward basis and/or may require pro rata repayment of certain tranches.

P1: ABC/ABC P2:c/d QC:e/f T1:g

c05 JWBT063-Rosenbaum March 18, 2009 15:37 Printer Name: Hamilton

222 LEVERAGED BUYOUTS

sources and uses of funds on the transaction summary page (see Exhibit 5.46). Unlike

traditional bank debt, high yield bonds are not prepayable without penalty and do

not have a mandatory repayment schedule prior to the bullet payment at maturity.

As a result, the model does not assume repayment of the high yield bonds prior

to maturity and the beginning and ending balances for each year in the projection

period are equal.

For the ValueCo LBO, we contemplated a senior subordinated notes issuance

of $300 million with a 10% coupon and a maturity of ten years. The notes are the

longest-tenored debt instrument in the financing structure. As the notes do not amor-

tize and there is no optional repayment due to the call protection period (standard

in high yield bonds), annual interest expense is simply $30 million ($300 million x

10%).

The completed debt schedule is shown in Exhibit 5.29.

Step IV(b): Complete Pro Forma Income Statement from EBIT to

Net Income

The calculated average annual interest expense for each loan, bond, or other debt

instrument in the capital structure is linked from the completed debt schedule to its

corresponding line item on the income statement (see Exhibit 5.30).

23

Cash Interest Expense Cash interest expense refers to a company’s actual cash

interest and associated financing-related payments in a given year. It is the sum of

the average interest expense for each cash-pay debt instrument plus the commitment

fee on the unused portion of the revolver and the administrative agent fee.

As shown in Exhibit 5.30, ValueCo is projected to have $58.5 million of cash

interest expense in 2009E. This amount decreases to $30.7 million by the end of the

projection period after the bank debt is repaid.

Total Interest Expense Total interest expense is the sum of cash and non-cash

interest expense, most notably the amortization of deferred financing fees, which is

linked from an assumptions page (see Exhibit 5.54). The amortization of deferred

financing fees, while technically not interest expense, is included in total interest

expense as it is a financial charge. In a capital structure with a PIK instrument, the

non-cash interest portion would also be included in total interest expense and added

back to cash flow from operating activities on the cash flow statement.

As shown in Exhibit 5.30, ValueCo has non-cash deferred financing fees of $2.5

million in 2009E. These fees are added to the 2009E cash interest expense of $58.5

million to sum to $60.9 million of total interest expense.

23

At this point, a circular reference centering on interest expense has been created in the

model. Interest expense is used to calculate net income and determine cash available for debt

repayment and ending debt balances, which, in turn, are used to calculate interest expense. The

spreadsheet must be set up to perform the circular calculation (in Microsoft Excel) by selecting

T

ools, Options, clicking on the “Calculation” tab, checking the box next to “Iteration,” and

setting the “Maximum iterations” field to 1000 (see Exhibit 3.30).

P1: ABC/ABC P2:c/d QC:e/f T1:g

c05 JWBT063-Rosenbaum March 18, 2009 15:37 Printer Name: Hamilton

EXHIBIT 5.29

Debt Schedule

($ in millions, fiscal year ending December 31)

Projection Period

Pro forma Year 1 Year 2

Year 3 Year 4 Year 5

Year 6

Year 7 Year 8 Year 9

Year 10

2008 2009 2010

2011 2012 2013

2014 2015 2016

2017 2018

Forward LIBOR Curve

5.10%

4.85%

4.80%

4.35%

4.00%

3.60%

3.30%

3.15%

3.00%

3.00%

5.25%

Cash Flow from Operating Activities

$65.3 $74.9 $83.4

$90.2 $96.3 $103.2 $110.7

$117.1

$128.8

$122.9

Cash Flow from Investing Activities

(21.6) (22.9) (23.8)

(24.5) (25.3) (26.0)

(26.8) (27.6)

(29.3)

(28.4)

Cash Available for Debt Repayment

$43.7 $52.0 $59.6

$71.1

$65.7

$77.2 $83.9 $89.5

$99.6

$94.4

Total Mandatory Repayments

MinCash

(4.5)

--

-

Cash from Balance Sheet

-

-

-

-

-

-

-

-

3.2

187.2

92.7

Cash Available for Optional Debt Repayment

$39.2 $47.5 $55.1

$66.6

$61.2

$72.7 $79.4

$187.2

$92.7

$286.7

Revolving Credit Facility

$100.0

Revolving Credit Facility Size

Spread

3.250%

Term

6 years

Commitment Fee on Unused Portion

0.50%

-

Beginning Balance

- - -

- - -

-

-

-

Drawdown / (Repayment)

- -

- -

-

- - -

-

-

-

Ending Balance

- -

-

-

-

-

-

-

-

Interest Rate

6.25% 6.40% 6.55%

6.85%

7.25%

7.60% 8.05%

8.10%

8.35%

8.50%

-

Interest Expense

- - -

- - -

-

-

-

0.5

Commitment Fee

0.5

0.5

0.5

0.5

0.5

0.5

0.5

0.5

0.5

Term Loan B Facility

$450.0

Size

Spread

3.500%

Term

7 years

Repayment Schedule

1.0%

per Annum, Bullet at Maturity

$450.0

Beginning Balance

$406.3 $354.2 $294.6

$228.9 $157.9 $80.7

-

-

-

Mandatory Repayments

(4.5) (4.5) (4.5) (4.5)

(4.5)

(4.5)

(4.5)

-

-

-

Optional Repayments

(39.2) (47.5) (55.1)

(61.2) (66.6)

(76.2)

(72.7)

-

-

-

$406.3

Ending Balance

$354.2 $294.6 $228.9

$157.9 $80.7

-

--

-

Interest Rate

6.50% 6.65% 6.80%

7.10% 7.50% 7.85%

8.30%

8.35%

8.60% 8.75%

27.8

Interest Expense

25.3

22.1 18.6 14.5

9.4

3.3 -

-

-

Senior Subordinated Notes

$300.0

Size

Coupon

10.000%

Term

10 years

$300.0

Beginning Balance

$300.0 $300.0 $300.0

$300.0 $300.0 $300.0

$300.0 $300.0 $300.0

Repayment

-

- - - - - - -

-

-

$300.0

Ending Balance

$300.0 $300.0 $300.0

$300.0 $300.0 $300.0

$300.0 $300.0 $300.0

30.0

Interest Expense

30.0

30.0 30.0 30.0

30.0 30.0 30.0

30.0

30.0

Debt Schedule

(4.5)

(4.5)

(4.5)

(4.5)

(4.5)

(4.5)

223

P1: ABC/ABC P2:c/d QC:e/f T1:g

c05 JWBT063-Rosenbaum March 18, 2009 15:37 Printer Name: Hamilton

224 LEVERAGED BUYOUTS

EXHIBIT 5.30 Pro Forma Projected Income Statement – EBIT to Net Income

($ in millions, fiscal year ending December 31)

Projection Period

Pro forma Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

2008

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

$130.0EBIT $140.4 $148.8 $154.8 $159.4 $164.2 $169.1 $174.2 $179.4 $184.8 $190.4

13.0% % margin 13.0% 13.0% 13.0% 13.0% 13.0% 13.0% 13.0% 13.0% 13.0% 13.0%

Interest Expense -----------

Revolving Credit Facility - ----------

29.3Term Loan B 27.8 25.3 22.1 18.6 14.5 9.4 3.3 - - -

30.0Senior Subordinated Notes 30.0 30.0 30.0 30.0 30.0 30.0 30.0 30.0 30.0 30.0

0.5Commitment Fee on Unused Revolver 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5

0.2Administrative Agent Fee

0.2 0.2

0.2 0.2

0.2 0.2 0.2 0.2 0.2

0.2

$59.9 Cash Interest Expense $58.5 $55.9 $52.7 $49.2 $45.2 $40.0 $34.0 $30.7 $30.7 $30.7

2.5Amortization of Deferred Financing Fees

2.5 2.5 2.5 2.5 2.5 2.5 2.2 1.0 1.0 1.0

$62.4 Total Interest Expense $60.9 $58.4 $55.2 $51.7 $47.6 $42.5 $36.2 $31.7 $31.7 $31.7

Interest Income

- - - -

--

(0.0) (1.4) (7.1) (4.2)

$60.9 Net Interest Expense $58.4 $55.2 $51.7 $47.6 $42.5 $36.1 $30.2 $27.5 $24.6

------ - - - -

79.5Earnings Before Taxes 90.4 99.6 107.7 116.6 126.7 138.1 149.2 157.3 165.8

30.2Income Tax Expense

34.4 37.9 40.9 44.3

48.1

52.5 56.7 59.8 63.0

$49.3 Net Income $56.1 $61.8 $66.8 $72.3 $78.5 $85.6 $92.5 $97.5 $102.8

4.6% % margin 4.9% 5.2% 5.4% 5.7% 6.0% 6.4% 6.7% 6.9% 7.0%

Income Statement

Net Interest Expense Net interest expense is calculated by subtracting interest

income received on cash held on a company’s balance sheet from its total interest

expense. In the ValueCo LBO, however, until 2015E (Year 7), when all prepayable

debt is repaid and cash begins to build on the balance sheet, there is no interest

income as the cash balance is zero. In 2016E, ValueCo is expected to earn interest

income of $1.4 million,

24

which is netted against total interest expense of $31.7

million to produce net interest expense of $30.2 million.

Net Income To calculate ValueCo’s net income for 2009E, we subtracted net inter-

est expense of $60.9 million from EBIT of $140.4 million, which resulted in earnings

before taxes of $79.5 million. We then multiplied EBT by ValueCo’s marginal tax

rate of 38% to produce tax expense of $30.2 million, which was netted out of EBT

to calculate net income of $49.3 million.

Net income for each year in the projection period is linked from the income

statement to the cash flow statement as the first line item under operating activities.

It also feeds into the balance sheet as an addition to shareholders’ equity in the form

of retained earnings.

The completed pro forma income statement is shown in Exhibit 5.31.

Step IV(c): Complete Pro Forma Balance Sheet

Liabilities The balance sheet is completed by linking the year-end balances for

each debt instrument directly from the debt schedule. The remaining non-current

and non-debt liabilities, captured in the other long-term liabilities line item, are

generally held constant at the prior year level in the absence of specific management

guidance.

24

Assumes a 3% interest rate earned on cash (using an average balance method), which is

indicative of a short-term money market instrument.