Paul Hopkin. Fundamentals of Risk Management

Подождите немного. Документ загружается.

174 Risk and organizations

describe the importance of the supply chain and the contribution of supply chain risk •

management to the success of the organization;

give examples of the risks associated with outsourcing and how these risks can be suc- •

cessfully managed.

Part 4 Further reading

APM Publishing (2004) Project Risk Analysis and Management Guide, www.apm.org.uk.

Institute of Risk Management (2005) Risk Management Organization and Context, www.theirm.org.

London Stock Exchange (2004) Corporate Governance A Practical Guide, www.londonstockexchange.com.

Reuvid (2008) Managing Business Risk, www.koganpage.com.

19

Corporate governance model

Corporate governance

Corporate governance covers a very wide range of topics, and risk management is an integral

part of the successful corporate governance of every organization. Most countries in the world

place corporate governance requirements on organizations. These requirements are particu-

larly strong in relation to companies quoted on stock exchanges, organizations that are regis-

tered charities and government departments, agencies and authorities. For instance, companies

listed on the London Stock Exchange have to be guided by the Combined Code on Corporate

Governance published by the Financial Reporting Council.

The purpose of corporate governance is to facilitate accountability and responsibility for effi -

cient and effective performance and ethical behaviour. It should protect executives and

employees in undertaking the work they are required to do. Finally, it should ensure stake-

holder confi dence in the ability of the organization to identify and achieve outcomes that its

stakeholders value.

There are two main approaches to the enforcement of corporate governance standards. Some

countries treat corporate governance requirements as ‘comply or explain’. In other words, the

organization should comply with the requirements or explain why it was not appropriate, nec-

essary or feasible to comply. If appropriate, an organization could explain that an alternative

approach was taken to achieve the same result. In these countries, the requirements may be

regarded as one means of achieving good practice, but equally effective alternative arrange-

ments are also acceptable.

Other countries require full compliance with detailed requirements, although limited alterna-

tives for achieving compliance are sometimes included within these requirements. In these

countries detailed compliance is expected and exceptions would not be acceptable.

Corporate governance requirements should be viewed as obligations placed on the board of an

organization. These requirements are placed on board members by legislation and by various

175

176 Risk and organizations

codes of practice. Often, these corporate governance requirements are presented as detailed

codes of practice. To start the process of enhancing corporate governance standards, an organ-

ization may develop a code of ethics for company directors, together with appropriate ‘delega-

tion of authority’ documents. An annual statement of confl ict of interest should be required

from directors and training should be provided for the board on corporate governance.

Also, the organization should set up appropriate committees (as listed below) with established

terms of reference and membership of each of these committees, which may be established as

sub-committees of the board. Reports on corporate governance standards, concerns and activ-

ities should be received at every board meeting and these papers will often be presented by the

company secretary.

risk management committee; •

audit committee; •

disclosures committee; •

nominations committee; •

remuneration committee. •

OECD principles of corporate governance

A basic defi nition of corporate governance is ‘the system by which organizations are directed and

controlled’. Corporate governance is therefore concerned with systems, processes, controls,

accountabilities and decision making at the highest level and throughout an organization.

Because corporate governance is concerned with the way that senior management fulfi l their

responsibilities and authority, there is a large component of risk management contained in the

overall corporate governance structure for every organization. Corporate governance is con-

cerned with the need for openness, integrity and accountability in decision making and this is

relevant to all organizations regardless of size or whether in the public or private sector.

The Organization for Economic Cooperation and Development (OECD) is an international

organization helping governments tackle the economic, social and governance challenges of a

globalized economy. The OECD has established a set of principles for corporate governance

and these are set out in Table 19.1. These principles focus on the development of an effective

corporate governance framework that pays due regard to the rights of stakeholders.

The principles require the equitable treatment of all stakeholders and an infl uential role for

stakeholders in corporate governance. Finally, the principles require disclosure and transpar-

ency. All of these principles are delivered by the board of the organization and the principles,

therefore, make detailed reference to the responsibilities of the board.

Corporate governance model 177

Table 19.1 OECD principles of corporate governance

1. Effective corporate governance framework

Promote transparent and effi cient markets, be consistent with the rule of law and

clearly articulate the division of responsibilities

2. Rights of shareholders

Protect and facilitate the exercise of the rights of shareholders

3. Equitable treatment of shareholders

Equitable treatment of all shareholders, including minority and foreign shareholders

4. Role of stakeholders in corporate governance

Recognize the rights of stakeholders and encourage active co-operation in creating

wealth, jobs and sustainability

5. Disclosure and transparency

Timely and accurate disclosure is made on all material matters, including the

fi nancial situation, performance, ownership, and governance

6. Responsibilities of the board

Strategic guidance of the company, effective monitoring of management by the

board and accountability of the board to the company and shareholders

LSE corporate governance framework

The London Stock Exchange (LSE) has produced guidance on corporate governance and the

focus of that guidance is on the effectiveness of the board. In the view of LSE, corporate gov-

ernance is about the effective management of the organization and the appropriate responsi-

bilities and the role of the senior managers and board members within the organization.

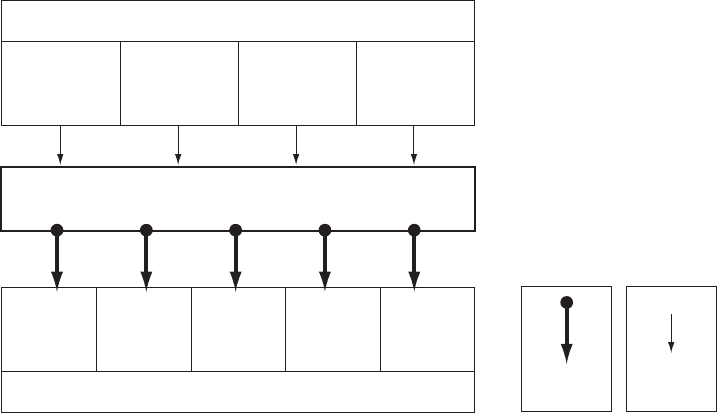

Figure 19.1 provides a summary representation of the London Stock Exchange governance

framework. Governance activities are centred on the board of the organization and the LSE

guidance refers to these boards as supervisory and managerial boards. The corporate govern-

ance framework has two main components. These components are: 1) the responsibilities,

obligations and rewards of board members, and 2) the fulfi lment of stakeholder expectations,

rights, participation and dialogue.

The importance of board member responsibilities, obligations and rewards are emphasized

and include arrangements for:

determining membership of the board; •

accountability of board members; •

178 Risk and organizations

Board members’ responsibilities, obligations and rewards

Supervisory and managerial boards

1.

Membership

2.

Accountability

3.

Delegation

4.

Remuneration

Stakeholder expectations, rights, participation and dialogue

* Corporate social responsibility

1.

Strategy

2.

CSR*

3.

Risk

4.

Audit

5.

Disclosure

Governance

by the board

Governance

of the board

Figure 19.1 Corporate governance framework

delegation of authority from the board; •

remuneration of board members. •

The responsibilities of board members must be fulfi

lled in fi

ve important areas, in respect of

the fulfi lment of stakeholder expectations, rights, participation and dialogue. In summary,

these fi ve areas are as follows:

strategic thinking, planning and implementation; •

corporate social responsibility; •

effective management of risks; •

audit and risk assurance; •

full and accurate disclosure. •

The OECD principles and the LSE corporate governance framework provide the overall

requirements and framework within which corporate governance must be delivered. However,

the processes that are used to deliver each of the fi

ve areas of stakeholder expectation will

vary.

Risk management activities should be viewed within the wider framework of corporate gov-

ernance. Although risk management is presented as a separate component of corporate gov-

ernance in the LSE framework, risk issues also underpin strategy, corporate social

responsibility, audit and disclosure.

Corporate governance model 179

Corporate governance for a bank

Corporate governance and risk management activities within a fi nancial organization are

strictly governed and regulated. Most fi nancial organizations, including banks, produce their

own internal corporate governance guidelines. Typically, these guidelines will cover director

qualifi cations, director responsibilities and the responsibilities and delegated authority of

board committees. The guidelines should also consider arrangements for the annual perform-

ance evaluation of the board and the arrangements for senior management succession.

The corporate governance structure will normally be a set of governing principles for the

conduct of the board of directors. These governing principles will include information for

board members on dealing with confl icts of interest, confi dentiality and compliance with laws,

rules and regulations.

A major part of ensuring adequate corporate governance for a fi nancial institution will be

adequate training and induction for board members. Typically, the orientation programme

for new members of the board will include details of:

the legal and regulatory framework; •

risk management; •

capital management and group accounting; •

human resources and compensation; •

audit committee, internal audit and external audit; •

communication, including branding. •

The global fi

nancial crisis has resulted in banks and other fi nancial institutions reviewing their own

corporate governance standards. The review in the box below provides an overview of a large

national bank and sets out criticisms of that bank in relation to failures of corporate governance.

Operational risk

The bank is the largest fi nancial services institution listed on the national stock

exchange and is among the 30 most profi table fi nancial services organizations in the

world. In January 2004, the bank disclosed to the public that it had identifi ed

substantial losses relating to unauthorized trading in foreign currency options. These

losses were classifi ed as operational risk.

Concurrent issues of further substantial losses on home loans called into question the

strength of the risk management practices and lack of auditor independence,

reinforcing the view that corporate governance had not been given the priority it

deserved over a number of years.

180 Risk and organizations

Corporate governance for a government agency

For government agencies, robust corporate governance arrangements are usually mandatory.

Also, for many government agencies, the main reason for paying attention to risk manage-

ment is to ensure that adequate corporate governance arrangements are in place. In other

words, the main motivation for ensuring good standards of risk management in a typical gov-

ernment agency will be the desire to support the corporate governance arrangements in the

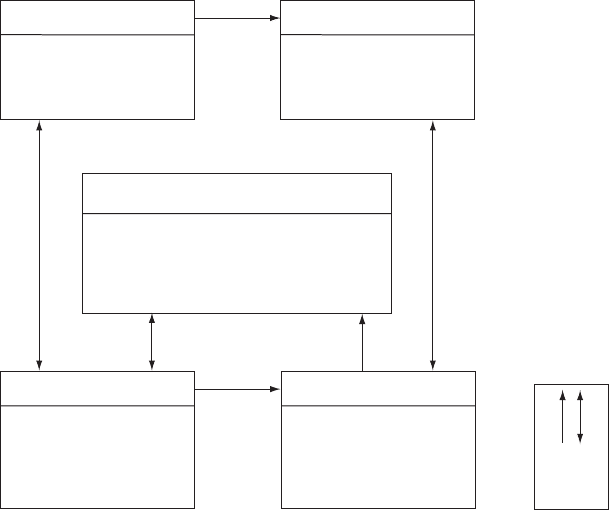

agency. Figure 19.2 shows the corporate governance components for a typical government

agency.

For commercial organizations, corporate governance and risk management are designed to

assist the organization to achieve its objectives, including commercial or marketplace objec-

tives. The motivation for government departments to ensure good standards of corporate

governance is narrower and is often focused on accountability.

In government agencies, the driving principles include value for money and avoidance of

inappropriate behaviour. Corporate governance is often seen by government agencies as estab-

lishing a framework of control that supports innovation, integrity and accountability and

encourages good management throughout the organization.

Corporate risks

• Long-term (strategic) risks

• Medium-term (tactical) risks

• Short-term (operational) risks

• Risks identied and escalated from project,

programme and local risk registers

Strategy

• Strategic context

• Available resources

• Delivery expectations

• Required changes

Balanced scorecard

• Adopted framework

• Strategic imperatives

• Current status

• Actions in hand

Business plan

• Urgent actions that need

to be taken

• Timescale for completion

• Responsibility for the

required actions

Executive committee

• Monthly risk review

• Changed assumptions

• Forecast performance

• Agreed risk performance

standards and metrics

Inuence

and/or

Inform

Figure 19.2 Corporate governance in a government agency

Corporate governance model 181

Within the corporate governance framework, responsibilities of individual members of staff

are frequently specifi ed. The reporting structure for risk issues is also outlined. Linking risk

management efforts to corporate governance can also enable specifi c areas of risk to be identi-

fi ed for particular attention. Typically, these will include value for money, business continuity,

fraud prevention and IT security assurance. Underpinning corporate governance activities

within a government department, agency or authority will be the principles of public life,

often referred to as the Nolan principles. These are set out in Table 19.2

Table 19.2 Nolan principles of public life

1. Selfl essness

Holders of public offi ce should act solely in terms of the public interest and should

not seek benefi ts for themselves, their family or friends

2. Integrity

Holders of public offi ce should not place themselves under any fi nancial or other

obligation to outside individuals or organizations

3. Objectivity

In carrying out public business, the holders of public offi ce should make choices

on merit

4. Accountability

Holders of public offi ce are accountable for their decisions and actions to the

public and must submit themselves to appropriate scrutiny

5. Openness

Holders of public offi ce should be as open as possible about all the decisions and

actions that they take and give reasons for their decisions

6. Honesty

Holders of public offi ce have a duty to declare any private interests relating to their

public duties and to take steps to resolve any confl icts

7. Leadership

Holders of public offi ce should promote and support these principles by leadership

and example

182 Risk and organizations

The box below provides an example of the importance of corporate governance arrangements

within a government agency. The important contribution of risk management and corporate

governance arrangements and management practices is highlighted in this example.

Welsh Assembly Government – Risk management policy

The risk policy of the Welsh Assembly Government (WAG) sets out policy on the

identifi cation and management of risks that it faces in the delivery of its objectives. Its

aims are to ensure that risk is taken into account at all stages in the development and

delivery of WAG activities, including risk analysis, the development of actions to

manage risks, and to monitor, review and evaluate such activity.

The Accounting Offi cer and Strategic Delivery & Performance Board of the Welsh

Assembly Government have adopted the following risk management policy to create

the environment and structures for the implementation of the WAG Plans, to:

ensure that the objectives of the Welsh Assembly Government are not adversely •

affected by signifi

cant risks that have not been anticipated;

ensure achievement of outputs and outcomes and having reliable contingency •

arrangements to deal with the unexpected that might put service delivery at

risk;

promote a more innovative, less risk-averse culture in which the taking of •

appropriate risks in pursuit of opportunities to benefi

t the WAG is encouraged;

provide a sound basis for integrating risk management into decision making; •

form a component of excellent corporate governance and management •

practices.

Risk Improvement Manager

Corporate Governance and Assurance

Welsh Assembly Government

February 2008

Evaluation of board performance

Evaluation of board performance is a critically important part of the corporate governance

arrangements for any organization. Table 19.3 provides a checklist of issues that should be

included in the evaluation of the effectiveness of a board. The areas for evaluation are as

follows:

Corporate governance model 183

membership and structure; •

purpose and intent; •

involvement and accountability; •

monitoring and review; •

performance and impact. •

The checklist set out in Table 19.3 focuses on corporate governance effort and on the level of

performance of the board. When deciding issues related to strategy, projects and operations,

the board will need to ensure that adequate processes are in place for reaching decisions. These

decisions will result in a course of action and the implementation of that course of action

needs to be monitored.

Table 19.3 Evaluating the effectiveness of the board

Membership and structure

Does the board have the necessary range of knowledge, skills and experience?

•

Is there appropriate turnover of board membership to ensure new ideas? •

Are the sub-committees of the board effective with appropriate delegated authority? •

Are board decision-making processes satisfactory with adequate information available? •

Do communication processes exist between board members outside board meetings? •

Purpose and intent

Do all board members understand and share the vision and mission?

•

Do members of the board understand the objectives and position statements? •

Is there suffi cient knowledge and understanding of the signifi cant risks? •

Are board members suffi ciently involved with the development of strategy? •

Have measurable budget and performance targets been put in place • ?

Involvement and accountability

Does the board have shared ethical values, including openness and honesty?

•

Are the established policies unambiguous and consistent with the ethics? •

Do board members understand their duties, responsibilities and obligations? •

Is there a feeling of mutual trust and respect at board meetings? •

Are there adequate delegation and authorization procedures in place • ?