Hull J.C. Risk management and Financial institutions

Подождите немного. Документ загружается.

Valuing European Options 415

the option is 53.44, the delta of the option is 0.45, the gamma is 0.0023, the

theta is -0.22, the vega is 3.33, and rho is 2.44. Note that the formula in

Table C.l gives theta per year. The theta quoted here is per calendar day.

The calculations in this appendix can be done with the DerivaGem

software on the author's website by selecting Analytic European for the

Option Type. Option valuation is described more fully in Hull (2006).

1

1

See J. C. Hull, Options, Futures, and Other Derivatives, 6th edn., Prentice Hall, 2006.

Valuing

American Options

To value American-style options, we divide the life of the option into n

time steps of length Suppose that the asset price at the beginning of a

step is S. At the end of the time step it moves up to Su with probability p

and down to Sd with probability 1 — p. For an investment asset that

provides no income, the values of u, d and p are given by

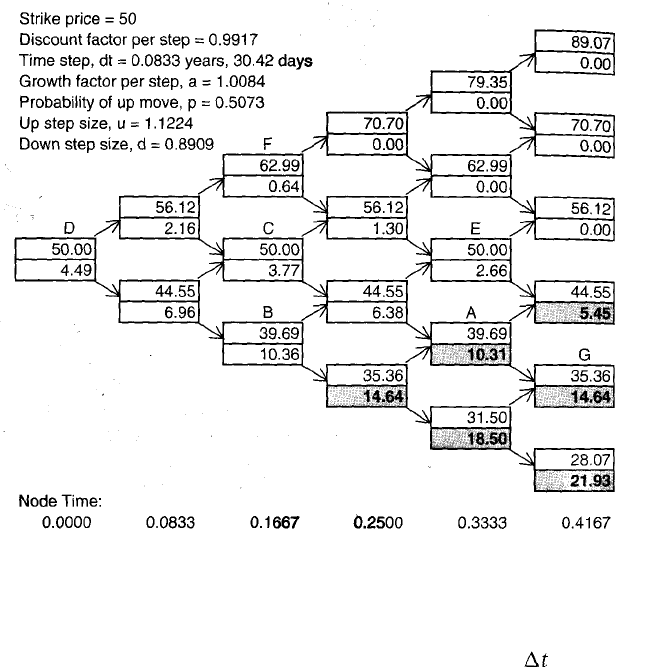

Figure D.l shows the tree constructed for valuing a five-month American

put option on a non-dividend-paying stock where the initial stock price is

50, the strike price is 50, the risk-free rate is 10%, and the volatility is

40%. In this case, there are five steps, so that = 0.08333, u = 1.1224,

d = 0.8909, a — 1.0084, and p = 0.5073. The upper number at each node

is the stock price and the lower number is the value of the option.

At the final nodes of the tree the option price is its intrinsic value. For

example, at node G the option price is 50 — 35.36 = 14.64. At earlier nodes

we first calculate a value assuming that the option is held for a further time

period of length At and then check to see whether early exercise is optimal.

Consider first node E. If the option is held for a further time period it will

be worth 0.00 if there is an up move (probability: p) and 5.45 if there is a

418

Appendix D

Figure D.1 Binomial tree from DerivaGem for an American put on a

non-dividend-paying stock.

down move (probability: 1 — p). The expected value in time is therefore

0.5073 x 0 + 0.4927 x 5.45, or 2.686, and the 2.66 value at node E is

calculated by discounting this at the risk-free rate of 10% for one month.

The option should not be exercised at node E as the payoff from early

exercise would be zero. Consider next node A. A similar calculation to that

just given shows that, assuming it is held for a further time period, the

option's value at node A is 9.90. If exercised, its value is 50 — 39.69 =

10.31. In this case, it should be exercised and the value of being at node A

is 10.31.

Continuing to work back from the end of the tree to the beginning, the

value of the option at the initial node D is found to be 4.49. As the number

of steps on the tree is increased, the accuracy of the option price increases.

At each node:

Upper value = Underlying Asset Price

Lower value = Option Price

Shading indicates where option is exercised

Valuing American Options 419

With 30, 50, and 100 time steps, we get values for the option of 4.263,

4.272, and 4.278.

To calculate delta, we consider the two nodes at time In our

example, as we move from the lower node to the upper node the option

price changes from 6.96 to 2.16 and the stock price changes from 44.55 to

56.12. The estimate of delta is the change in the option price divided by

the change in the stock price:

To calculate gamma, we consider the three nodes at time The delta

calculated from the upper two nodes (C and F) is —0.241. This can be

regarded as the delta for a stock price of (62.99 + 50)/2 = 56.49. The

delta calculated from the lower two nodes (B and C) is —0.639. This can

be regarded as the delta for a stock price of (50 + 39.69)/2 = 44.84. The

estimate of gamma is the change in delta divided by the change in the

stock price:

We estimate theta from nodes D and C as

or —4.30 per year. This is -0.0118 per calendar day. Vega is estimated by

increasing the volatility, constructing a new tree, and observing the effect

of the increased volatility on the option price. Rho is calculated similarly.

When the asset underlying the option provides a yield at rate q the

procedure is exactly the same except that a = instead of in the

equation for p. The calculations we have described can be done using the

DerivaGem software by selecting Binomial American for the Option

Type. Binomial trees and other numerical procedures are described more

fully in Hull (2006).

1

1

See J. C. Hull, Options, Futures, and Other Derivatives, 6th edn., Prentice Hall, 2006.

Suppose that A is an N x N matrix of credit rating changes in one year.

This is a matrix such as the one shown in Table 12.1. The matrix of credit

rating changes in m years is A

m

. This can be readily calculated using the

normal rules for matrix multiplication.

The matrix corresponding to a shorter period than one year, say six

months or one month, is more difficult to compute. We first use standard

routines to calculate eigenvectors and the corresponding

eigenvalues These have the property that

Define X as a matrix whose ith row is and a s a diagonal matrix

where the ith diagonal element is A standard result in matrix algebra

shows that

From this it is easy to see that the nth root of A is

where is a diagonal matrix where the ith diagonal element is

Some authors, such as Jarrow, Lando, and Turnbull,

1

prefer to handle

1

See R. A. Jarrow, D. Lando, and S. M. Turnbull, "A Markov Model for the Term

Structure of Credit Spreads," Review of Financial Studies, 10 (1997), 481-523.

The Manipulation

of Credit Transition

Matrices

422

Appendix E

this problem in terms of what is termed a generator matrix. This is a

matrix such that the transition matrix for a short period of time is

I + where I is the identity matrix, and the transition matrix for a

longer period of time t is

Answers to Questions

and Problems

CHAPTER 1

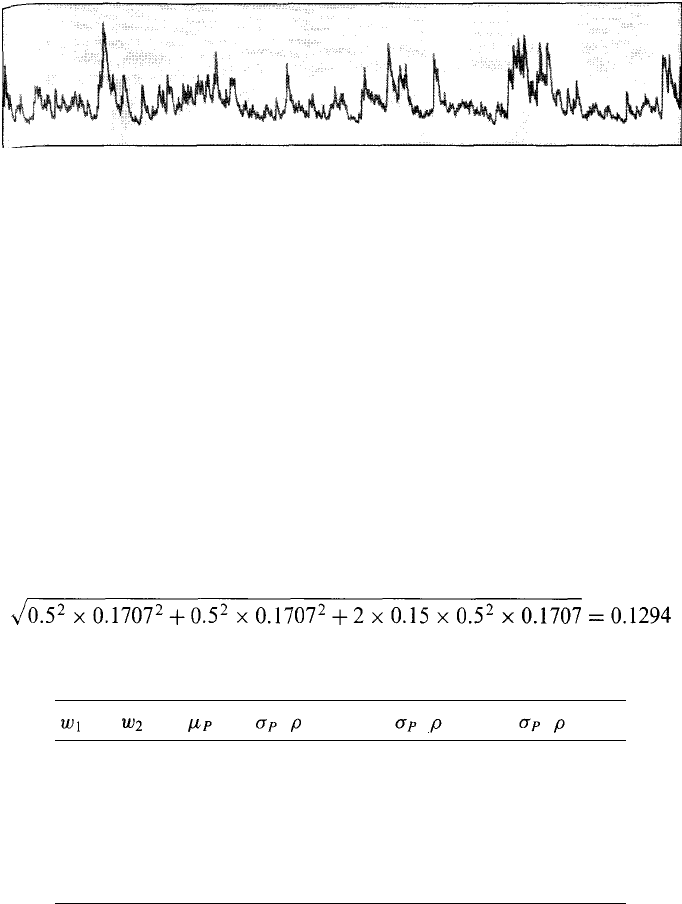

1.1. Expected return is 12.5%. SD of return is 17.07%.

1.2. From equations (1.1) and 1.2), expected return is 12.5%. SD of

return is

or 12.94%.

1.3.

0.0

0.2

0.4

0.6

0.8

1.0

1.0

0.8

0.6

0.4

0.2

0.0

15%

14%

13%

12%

11%

10%

( =0.3)

24.00%

20.39%

17.42%

15.48%

14.96%

16.00%

( =1)

24.00%

22.40%

20.80%

19.20%

17.60%

16.00%

( =-1)

24.00%

16.00%

8.00%

0.00%

8.00%

16.00%

1.4. Nonsystematic risk can be diversified; systematic risk cannot. Sys-

tematic risk is most important to an equity investor. Either type of risk

can lead to the bankruptcy of a corporation.

1.5. We assume that investors trade off mean return and standard

deviation of return. For a given mean return, they want to minimize

424 Answers to Problems and Questions

standard deviation of returns. All make the same estimates of means

standard deviations, and coefficients of correlation for returns on indi-

vidual investments. Furthermore they can borrow or lend at the risk-free

rate. The result is that they all want to be on the "new efficient frontier"

in Figure 1.4. They choose the same portfolio of risky investments

combined with borrowing or lending at the risk-free rate.

1.6. (a) 7.2%, (b) 9%, (c) 14.4%.

1.7. The capital asset pricing theory assumes that there is one factor

driving returns. Arbitrage pricing theory assumes multiple factors.

1.8. In many jurisdictions, interest on debt is deductible to the corporation

whereas dividends are not deductible. It can therefore be more tax efficient

for a company to fund itself with debt. However, as debt increases, the

probability of bankruptcy increases.

1.9. When potential losses are large, we cannot aggregate them and

assume they will be diversified away. It is necessary to consider them

one by one and handle them with insurance contracts, tighter internal

controls, etc.

1.10. This is the probability that profit is no worse than —4% of assets.

This profit level is 4.6/1.5 = 3.067 standard deviations from the mean. The

probability that the bank will have a positive equity is therefore N(3.067),

where N is the cumulative normal distribution function. This is 99.89%.

1.11. Banks have the privilege of being allowed to take money from

depositors. Companies in retailing and manufacturing do not.

1.12. There was an interest rate mismatch at Continental Illinois. About

$5.5 billion of loans with maturities more than a year were financed by

deposits with maturities less than a year. If interest rates rose 1%, the

deposits would be rolled over at higher rates while the loans would

continue to earn the same rate. The cost to Continental Illinois would

be $55 million.

1.13. S&Ls financed long-term fixed-rate mortgages with short-term

deposits creating a serious interest rate mismatch. As a result, they lost

money when interest rates rose.

1.14. In this case, the interest rate mismatch is $10 billion. The bank's net

interest income declines $100 million each year for the next three years.

1.15. Professional fees ($5 million per month), lost sales (people are

reluctant to do business with a company that is being reorganized), and

key senior executives left (lack of continuity).

Answers to Problems and Questions 425

CHAPTER 2

2.1. When a trader enters into a long forward contract, she is agreeing to

buy the underlying asset for a certain price at a certain time in the future.

When a trader enters into a short forward contract, she is agreeing to sell

the underlying asset for a certain price at a certain time in the future.

2.2. A trader is hedging when she has an exposure to the price of an asset

and takes a position in a derivative to offset the exposure. In a speculation

the trader has no exposure to offset. She is betting on the future move-

ments in the price of the asset. Arbitrage involves taking a position in two

or more different markets to lock in a profit.

2.3. In the first case, the trader is obligated to buy the asset for $50 (she

does not have a choice). In the second case, the trader has an option to

buy the asset for $50 (she does not have to exercise the option).

2.4. Selling a call option involves giving someone else the right to buy an

asset from you for a certain price. Buying a put option gives you the right

to sell the asset to someone else.

2.5. (a) The investor is obligated to sell pounds for 1.5000 when they are

worth 1.4900. The gain is (1.5000 - 1.4900) x 100,000 = $1,000. (b) The

investor is obligated to sell pounds for 1.5000 when they are worth 1.5200.

The loss is (1.5200 - 1.5000) x 100,000 = $2,000.

2.6. (a) The trader sells for 50 cents per pound something that is worth

48.20 cents per pound. Gain = ($0.5000 - $0.4820) x 50,000 = $900.

(b) The trader sells for 50 cents per pound something that is worth 51.30

cents per pound. Loss = ($0.5130 - $0.5000) x 50,000 = $650.

2.7. You have sold a put option. You have agreed to buy 100 shares for

$40 per share if the party on the other side of the contract chooses to

exercise the right to sell for this price. The option will be exercised only

when the price of stock is below $40. Suppose, for example, that the

option is exercised when the price is $30. You have to buy at $40 shares

that are worth $30; you lose $10 per share, or $1,000 in total. If the

option is exercised when the price is $20, you lose $20 per share, or $2,000

in total. The worst that can happen is that the price of the stock declines

to almost zero during the three-month period. This highly unlikely event

would cost you $4,000. In return for the possible future losses, you receive

the price of the option from the purchaser.

2.8. The over-the-counter (OTC) market is a telephone- and computer-

linked network of financial institutions, fund managers, and corporate

treasurers where two participants can enter into any mutually acceptable

426

Answers to Problems and Questions

contract. An exchange-traded market is a market organized by an ex-

change where traders either meet physically or communicate electronically

and the contracts that can be traded have been defined by the exchange

(a) OTC, (b) exchange, (c) both, (d) OTC, (e) OTC.

2.9. One strategy would be to buy 200 shares. Another would be to buy

2,000 options. If the share price does well, the second strategy will give

rise to greater gains. For example, if the share price goes up to $40, you

gain [2, 000 x ($40 - $30)] - $5,800 = $14,200 from the second strategy

and only 200 x ($40 - $29) = $2,200 from the first. However, if the

share price does badly, the second strategy gives greater losses. For

example, if the share price goes down to $25, the first strategy leads

to a loss of 200 x ($29 — $25) = $800, whereas the second strategy leads

to a loss of the whole $5,800 investment. This example shows that

options contain built in leverage.

2.10. You could buy 5,000 put options (or 50 contracts) with a strike

price of $25 and an expiration date in 4 months. This provides a type of

insurance. If at the end of 4 months the stock price proves to be less than

$25, you can exercise the options and sell the shares for $25 each. The

cost of this strategy is the price you pay for the put options.

2.11. A stock option provides no funds for the company. It is a security

sold by one trader to another. The company is not involved. By contrast,

a stock when it is first issued is a claim sold by the company to investors

and does provide funds for the company.

2.12. Ignoring the time value of money, the holder of the option will

make a profit if the stock price in March is greater than $52.50. This is

because the payoff to the holder of the option is, in these circumstances,

greater than the $2.50 paid for the option. The option will be exercised if

the stock price at maturity is greater than $50.00. Note that if the stock

price is between $50.00 and $52.50 the option is exercised, but the holder

of the option takes a loss overall.

2.13. Ignoring the time value of money, the seller of the option will make

a profit if the stock price in June is greater than $56.00. This is because

the cost to the seller of the option is in these circumstances less than the

price received for the option. The option will be exercised if the stock

price at maturity is less than $60.00. Note that if the stock price is

between $56.00 and $60.00 then the seller of the option makes a profit

even though the option is exercised.