Hull J.C. Risk management and Financial institutions

Подождите немного. Документ загружается.

102 Chapter 4

the three-month rate increases by 0.21 basis points, the six-month rate

increases by 0.26 basis points, and so on. The second factor is shown in

the column labeled PC2. It corresponds to a "twist" or change of slope of

the yield curve. Rates between three months and two years move in one

direction; rates between three years and 30 years move in the other

direction. The third factor corresponds to a "bowing" of the yield curve.

Rates at the short end and long end of the yield curve move in one

direction; rates in the middle move in the other direction. The interest rate

move for a particular factor is known as factor loading. In our example,

the first factor's loading for the three-month rate is 0.21.

9

As there are ten rates and ten factors, the interest rate changes observed

on any given day can always be expressed as a linear sum of the factors by

solving a set of ten simultaneous equations. The quantity of a particular

factor in the interest rate changes on a particular day is known as the

factor score for that day.

The importance of a factor is measured by the standard deviation of its

factor score. The standard deviations of the factor scores in our example

are shown in Table 4.10 and the factors are listed in order of their

importance. The numbers in Table 4.10 are measured in basis points. A

quantity of the first factor equal to one standard deviation, therefore,

corresponds to the three-month rate moving by 0.21 x 17.49 = 3.67 basis

points, the six-month rate moving by 0.26 x 17.49 = 4.55 basis points,

and so on.

The technical details of how the factors are determined are not covered

here. It is sufficient for us to note that the factors are chosen so that the

factor scores are uncorrelated. For instance, in our example, the first

factor score (amount of parallel shift) is uncorrelated with the second

factor score (amount of twist) across the 1,543 days. The variances of the

factor scores (i.e., the squares of the standard deviations) have the

property that they add up to the total variance of the data. From

Table 4.10, the total variance of the original data (i.e., sum of the

variance of the observations on the three-month rate, the variance of

the observations on the six-month rate, and so on) is

17.49

2

+ 6.05

2

+ 3.10

2

+ ... + 0.79

2

= 367.9

From this, it can be seen that the first factor accounts for

17.49

2

/367.9 = 83.1% of the variance in the original data; the first two

factors account for (17.49

2

+ 6.05

2

)/367.9 = 93.1% of the variance in the

9

The factor loadings have the property that the sum of their squares for each factor is 1.0.

Interest Rate Risk 103

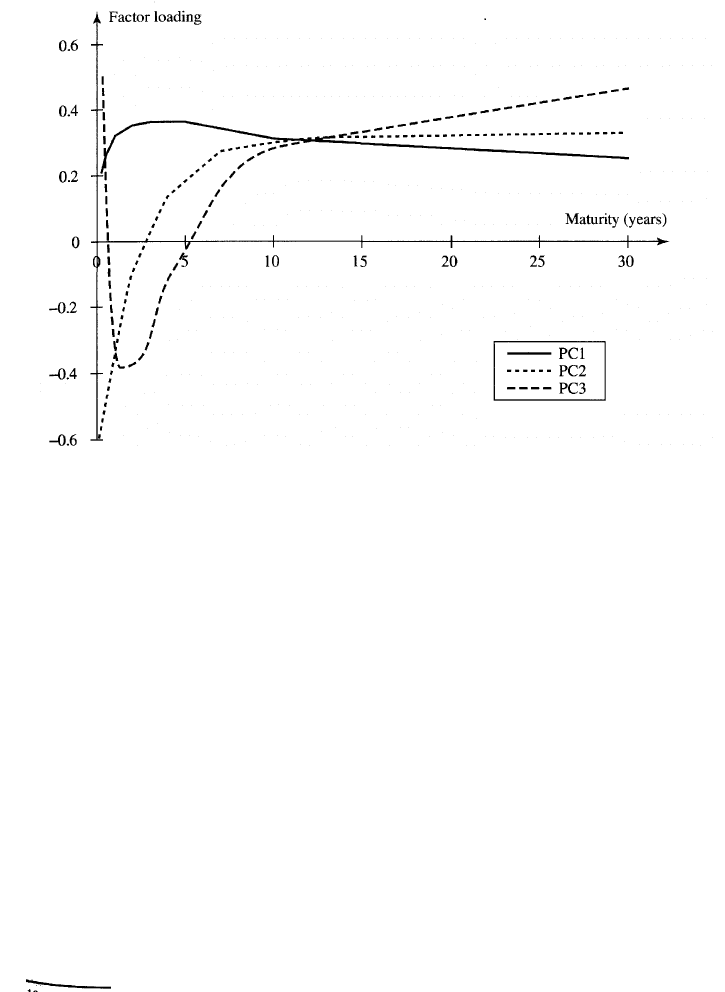

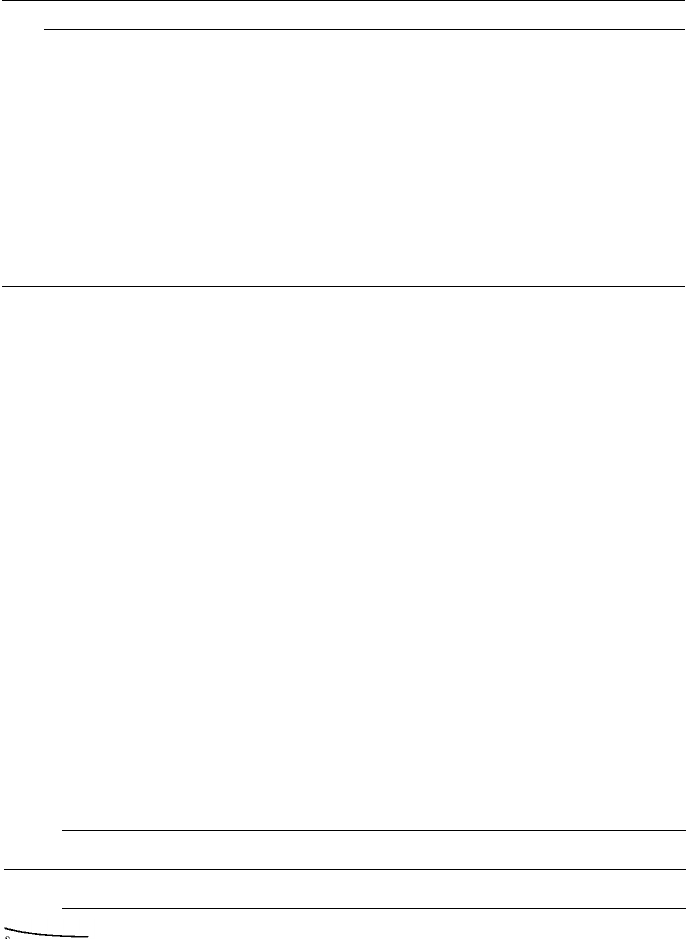

Figure 4.7 The three most important factors driving yield curve movements.

data; the third factor accounts for a further 2.6% of the variance. This

shows that most of the risk in interest rate moves is accounted for by the

first two or three factors. It suggests that we can relate the risks in a

portfolio of interest-rate-dependent instruments to movements in these

factors instead of considering all ten interest rates. The three most

important factors from Table 4.9 are plotted in Figure 4.7.

10

Using Principal Components Analysis to Calculate Deltas

To illustrate how a principal components analysis can provide an alter-

native way of calculating deltas, suppose we have a portfolio with the

exposures to interest rate moves shown in Table 4.11. A one-basis-point

change in the one-year rate causes the portfolio value to increase by

$10 million; a one-basis-point change in the two-year rate causes it to

increase by $4 million; and so on. We use the first two factors to model

rate moves. (As mentioned earlier, this captures over 90% of the un-

certainty in rate moves.) Using the data in Table 4.9, our delta exposure to

the first factor (measured in millions of dollars per factor-score basis

10

Results similar to those described here, with respect to the nature of the factors and

the amount of the total risk they account for, are obtained when a principal components

analysis is used to explain the movements in almost any yield curve in any country.

100 Chapter 4

be considered for the segment of the zero curve between 2.0 and 3.0 years

in Figure 4.3. Again, the sum of the deltas for all the segments equals

the DV01.

Calculating Deltas to Facilitate Hedging

One of the problems with the delta measures that we have considered so

far is that they are not designed to make hedging easy. Consider the deltas

in Table 4.8. If we plan to hedge our portfolio with zero-coupon bonds,

we can calculate the position in a one-year zero-coupon bond to zero out

the $200 per basis point exposure to the one-year rate, the position in a

two-year zero-coupon bond to zero out the exposure to the two-year rate,

and so on. But, if other instruments are used, a much more complicated

analysis is necessary.

In practice, traders tend to use positions in the instruments that have

been used to construct the zero curve to hedge their exposure. For

example, a government bond trader is likely to take positions in the

actively traded government bonds that were used to construct the Treas-

ury zero curve when hedging. A trader of instruments dependent on the

LIBOR/swap yield curve is likely to take positions in LIBOR deposits,

Eurodollar futures, and swaps when hedging.

To facilitate hedging, traders therefore often calculate the impact of

small changes in the quotes for each of the instruments used to construct

the zero curve. Consider a trader responsible for interest rate caps and

swap options. Suppose that the trader's exposure to a one-basis-point

change in a Eurodollar futures quote is $500. Each Eurodollar futures

contract changes in value by $25 for a one-basis-point change in the

Eurodollar futures quote. It follows that the trader's exposure can be

hedged with 20 contracts. Suppose that the exposure to a one-basis-point

change in the five-year swap rate is $4,000 and that a five-year swap with a

notional principal of $1 million changes in value by $400 for a one-basis-

point change in the five-year swap rate. The exposure can be hedged by

trading swaps with a notional principal of $10 million.

4.10 PRINCIPAL COMPONENTS ANALYSIS

The approaches we have just outlined can lead to analysts calculating

10 to 15 different deltas for every zero curve. This seems like overkill

because the variables being considered are quite highly correlated with

each other. For example, when the yield on a five-year bond moves up by

Interest Rate Risk 101

Table 4.9 Factor loadings for US Treasury data.

3m

6m

12m

2y

3y

4y

5y

7y

l0y

30y

PC1

0.21

0.26

0.32

0.35

0.36

0.36

0.36

0.34

0.31

0.25

PC2

-0.57

-0.49

-0.32

-0.10

0.02

0.14

0.17

0.27

0.30

0.33

PC3

0.50

0.23

-0.37

-0.38

-0.30

-0.12

-0.04

0.15

0.28

0.46

PC4

0.47

-0.37

-0.58

0.17

0.27

0.25

0.14

0.01

-0.10

-0.34

PC5

-0.39

0.70

-0.52

0.04

0.07

0.16

0.08

0.00

-0.06

-0.18

PC6

-0.02

0.01

-0.23

0.59

0.24

-0.63

-0.10

-0.12

0.01

0.33

PC7

0.01

-0.04

-0.04

0.56

-0.79

0.15

0.09

0.13

0.03

-0.09

PC8

0.00

-0.02

-0.05

0.12

0.00

0.55

-0.26

-0.54

-0.23

0.52

PC9

0.01

-0.01

0.00

-0.12

-0.09

-0.14

0.71

0.00

-0.63

0.26

PC10

0.00

0.00

0.01

-0.05

-0.00

-0.08

0.48

-0.68

0.52

-0.13

a few basis points, most of the time the yield on a ten-year bond does the

same. Arguably a trader should not be worried when a portfolio has a

large positive exposure to the five-year rate and a similar large negative

exposure to the ten-year rate.

One approach to handling the risk arising from groups of highly

correlated market variables is principal components analysis. This takes

historical data on movements in the market variables and attempts to

define a set of components or factors that explain the movements.

The approach is best illustrated with an example. The market variables

we will consider are ten US Treasury rates with maturities between three

months and 30 years. Tables 4.9 and 4.10 show results produced by Frye

for these market variables using 1,543 daily observations between 1989

and 1995.

8

The first column in Table 4.9 shows the maturities of the rates

that were considered. The remaining ten columns in the table show the

ten factors (or principal components) describing the rate moves. The first

factor, shown in the column labeled PC1, corresponds to a roughly

Parallel shift in the yield curve. When we have one unit of that factor,

Table 4.10 Standard deviation of factor scores (basis points).

8

See J. Frye, "Principals of Risk: Finding VAR through Factor-Based Interest Rate

Scenarios." In VAR: Understanding and Applying Value at Risk, Risk Publications,

London, 1997, pp. 275-288.

PC1

17.49

PC2

6.05

PC3

3.10

PC4

2.17

PC5

1.97

PC6

1.69

PC7

1.27

PC8

1.24

PC9

0.80

PC10

0.79

102

Chapter 4

the three-month rate increases by 0.21 basis points, the six-month rate

increases by 0.26 basis points, and so on. The second factor is shown in

the column labeled PC2. It corresponds to a "twist" or change of slope of

the yield curve. Rates between three months and two years move in one

direction; rates between three years and 30 years move in the other

direction. The third factor corresponds to a "bowing" of the yield curve.

Rates at the short end and long end of the yield curve move in one

direction; rates in the middle move in the other direction. The interest rate

move for a particular factor is known as factor loading. In our example,

the first factor's loading for the three-month rate is 0.21.

9

As there are ten rates and ten factors, the interest rate changes observed

on any given day can always be expressed as a linear sum of the factors by

solving a set of ten simultaneous equations. The quantity of a particular

factor in the interest rate changes on a particular day is known as the

factor score for that day.

The importance of a factor is measured by the standard deviation of its

factor score. The standard deviations of the factor scores in our example

are shown in Table 4.10 and the factors are listed in order of their

importance. The numbers in Table 4.10 are measured in basis points. A

quantity of the first factor equal to one standard deviation, therefore,

corresponds to the three-month rate moving by 0.21 x 17.49 = 3.67 basis

points, the six-month rate moving by 0.26 x 17.49 = 4.55 basis points,

and so on.

The technical details of how the factors are determined are not covered

here. It is sufficient for us to note that the factors are chosen so that the

factor scores are uncorrelated. For instance, in our example, the first

factor score (amount of parallel shift) is uncorrelated with the second

factor score (amount of twist) across the 1,543 days. The variances of the

factor scores (i.e., the squares of the standard deviations) have the

property that they add up to the total variance of the data. From

Table 4.10, the total variance of the original data (i.e., sum of the

variance of the observations on the three-month rate, the variance of

the observations on the six-month rate, and so on) is

17.49

2

+ 6.05

2

+ 3.10

2

+ • • • + 0.79

2

= 367.9

From this, it can be seen that the first factor accounts for

17.49

2

/367.9 = 83.1% of the variance in the original data; the first two

factors account for (17.49

2

+ 6.05

2

)/367.9 = 93.1% of the variance in the

9

The factor loadings have the property that the sum of their squares for each factor is 1.0.

Interest Rate Risk

103

Figure 4.7 The three most important factors driving yield curve movements.

data; the third factor accounts for a further 2.6% of the variance. This

shows that most of the risk in interest rate moves is accounted for by the

first two or three factors. It suggests that we can relate the risks in a

portfolio of interest-rate-dependent instruments to movements in these

factors instead of considering all ten interest rates. The three most

important factors from Table 4.9 are plotted in Figure 4.7.

10

Using Principal Components Analysis to Calculate Deltas

To illustrate how a principal components analysis can provide an alter-

native way of calculating deltas, suppose we have a portfolio with the

exposures to interest rate moves shown in Table 4.11. A one-basis-point

change in the one-year rate causes the portfolio value to increase by

$10 million; a one-basis-point change in the two-year rate causes it to

increase by $4 million; and so on. We use the first two factors to model

rate moves. (As mentioned earlier, this captures over 90% of the un-

certainty in rate moves.) Using the data in Table 4.9, our delta exposure to

the first factor (measured in millions of dollars per factor-score basis

10

Results similar to those described here, with respect to the nature of the factors and

the amount of the total risk they account for, are obtained when a principal components

analysis is used to explain the movements in almost any yield curve in any country.

104

Chapter 4

Table 4.11 Change in portfolio value for a

one-basis-point rate move ($ millions).

1-year

rate

+ 10

2-year

rate

+4

3-year

rate

-8

4-year

rate

-1

5-year

rate

+2

point) is

10 x 0.32 + 4 x 0.35 - 8 x 0.36 - 7 x 0.36 + 2 x 0.36 = -0.08

and our delta exposure to the second factor is

10 x (-0.32) + 4 x (-0.10) - 8 x 0.02 - 7 x 0.14 + 2 x 0.17 = -4.40

The approach being used here is similar to the approach described in

Section 4.8 where partial durations are used to estimate the impact of

nonparallel shifts. The advantage of using a principal components ana-

lysis is that it tells you which are the most appropriate shifts to consider.

It also provides information on the relative importance of different shifts.

In the example we have considered, our exposure to the second shift is

about 50 times greater than our exposure to the first shift. However, the

first shift is about three times as important in terms of the extent to which

it occurs. (We base this last statement on the standard deviation of factor

scores reported in Table 4.10.)

4.11 GAMMA AND VEGA

When several delta measures are calculated, there are many possible

gamma measures. Suppose that ten instruments are used to compute

the zero curve and that we measure deltas with respect to changes in

the quotes for each of these. Gamma is a second partial derivative of the

form , where P is the portfolio value. We have ten choices for

x

i

and ten choices for x

j

and a total of 55 different gamma measures. This

may be "information overload". One approach is to ignore cross-gammas

and focus on the ten partial derivatives where i = j. Another is to

calculate a single gamma measure as the second partial derivative of

the value of the portfolio with respect to a parallel shift in the zero curve.

A further possibility is to calculate gammas with respect to the first two

factors in a principal components analysis. ,

Interest Rate Risk 105

The vega of a portfolio of interest rate derivatives measures its

exposure to volatility changes. Different volatilities are used to price

different interest rate derivatives. One approach is to make the same

small change to all volatilities and calculate the effect on the value of the

portfolio. Another is to carry out a principal components analysis to

calculate factors that reflect the patterns of volatility changes across

different instruments that tend to occur in practice. Vega measures can

be calculated for the first two or three factors.

SUMMARY

The compounding frequency used for an interest rate defines the units in

which it is measured. The difference between an annually compounded

rate and a quarterly compounded rate is analogous to the difference

between a distance measured in miles and a distance measured in kilo-

meters. Analysts frequently use continuous compounding when analyzing

derivatives.

Many different types of interest rates are quoted in financial markets

and calculated by analysts. The n-year zero rate or n-year spot rate is the

rate applicable to an investment lasting for n years when all of the return

is realized at the end. Forward rates are the rates applicable to future

periods of time implied by today's zero rates.

A zero-coupon yield curve shows the zero rate as a function of

maturity. Two important zero-coupon yield curves for risk managers

are the Treasury zero curve and the LIBOR/swap zero curve. The method

most commonly used to calculate zero curves is known as the bootstrap

method. It involves starting with short-term instruments and moving to

progressively longer-term instruments making sure that the zero rates

calculated at each stage are consistent with the prices of the instruments.

An important concept in interest rate markets is duration. Duration

measures the sensitivity of the value of a portfolio to a small parallel shift

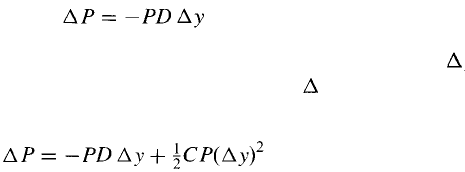

m the zero-coupon yield curve. An approximate relationship is

where P is the value of the portfolio, D is the duration of the portfolio, y

is the size of a small parallel shift in the zero curve, and P is the resultant

effect on the value of the portfolio. A more precise relationship is

106

Chapter 4

where C is the convexity of the portfolio. This relationship is accurate for

relatively large parallel shifts in the yield curve but does not quantify the

exposure to nonparallel shifts.

To quantify exposure to all the different ways the yield curve can

change through time, several duration or delta measures are necessary.

There are a number of ways these can be defined. A principal components

analysis can be a useful alternative to calculating multiple deltas. It shows

that the yield curve shifts that occur in practice are to a large extent a

linear sum of two or three standard shifts. If a portfolio manager is

hedged against these standard shifts, he or she is therefore also well

hedged against the shifts that occur in practice.

FURTHER READING

Allen, S. L., and A. D. Kleinstein. Valuing Fixed-Income Investments and

Derivative Securities. New York Institute of Finance, 1991.

Duffie, D. "Debt Management and Interest Rate Risk," in W. Beaver and

G. Parker (eds.) Risk Management: Challenges and Solutions. New York:

McGraw-Hill, 1994.

Fabozzi, F. J. Fixed-Income Mathematics: Analytical and Statistical Techniques.

New York: McGraw-Hill, 1996.

Fabozzi, F.J. Duration, Convexity, and Other Bond Risk Measures, Frank J.

Fabozzi Associates, 1999.

Grinblatt, M., and F.A. Longstaff. "Financial Innovation and the Role of

Derivatives Securities: An Empirical Analysis of the Treasury Strips

Program," Journal of Finance, 55, 3 (2000): 1415-1436.

Jorion, P. Big Bets Gone Bad: Derivatives and Bankruptcy in Orange County.

New York: Academic Press, 1995.

Stigum, M., and F. L. Robinson. Money Markets and Bond Calculations.

Chicago: Irwin, 1996.

QUESTIONS AND PROBLEMS (Answers at End of Book)

4.1. A bank quotes you an interest rate of 14% per annum with quarterly

compounding. What is the equivalent rate with (a) continuous compound-

ing and (b) annual compounding?

4.2. An investor receives $1,100 in one year in return for an investment of

$1,000 now. Calculate the percentage return per annum with (a) annual

Interest Rate Risk 107

compounding, (b) semiannual compounding, (c) monthly compounding,

and (d) continuous compounding.

4.3. A deposit account pays 12% per annum with continuous compounding,

but interest is actually paid quarterly. How much interest will be paid each

quarter on a $10,000 deposit?

4.4. What rate of interest with continuous compounding is equivalent to 15%

per annum with monthly compounding?

4.5. Suppose that zero interest rates with continuous compounding are as

follows:

Maturity

{years)

1

2

3

4

5

Rate

(% per annum)

2.0

3.0

3.7

4.2

4.5

Calculate forward interest rates for the second, third, fourth, and fifth

years.

4.6. Suppose that zero interest rates with continuous compounding are as

follows:

Maturity

(months)

3

6

9

12

15

18

Rate

(% per annum)

8.0

8.2

8.4

8.5

8.6

8.7

Calculate forward interest rates for the second, third, fourth, fifth, and

sixth quarters.

4.7. The term structure of interest rates is upward sloping. Put the following in

order of magnitude: (a) the five-year zero rate, (b) the yield on a five-year

coupon-bearing bond, and (c) the forward rate corresponding to the

period between 5 and 5.25 years in the future. What is the answer to this

question when the term structure of interest rates is downward sloping?

4.8. The six-month and one-year zero rates are both 10% per annum. For a

bond that has a life of 18 months and pays a coupon of 8% per annum