Hull J.C. Risk management and Financial institutions

Подождите немного. Документ загружается.

Financial Products and How They Are Used for Hedging 41

Table 2.6 Prices of options on Intel, May 29, 2003; stock price = $20.83.

Strike price

($)

20.00

22.50

Calls

June

1.25

0.20

July

1.60

0.45

Oct.

2.40

1.15

Puts

June

0.45

1.85

July

0.85

2.20

Oct.

1.50

2.85

gives the closing prices of some of the American options trading on Intel

on May 29, 2003. The option strike prices are $20 and $22.50. The

maturities are June 2003, July 2003, and October 2003. The June options

have an expiration date of June 21, 2003; the July options have an

expiration date of July 19, 2003; the October options have an expiration

date of October 18, 2003. Intel's stock price at the close of trading on

May 29, 2003, was $20.83.

Suppose an investor instructs a broker to buy one October call option

contract on Intel with a strike price of $22.50. The broker will relay these

instructions to a trader at the CBOE. This trader will then find another

trader who wants to sell one October call contract on Intel with a strike

price of $22.50, and a price will be agreed upon. We assume that the price

is $1.15, as indicated in Table 2.6. This is the price for an option to buy

one share. In the United States, one stock option contract is a contract to

buy or sell 100 shares. Therefore the investor must arrange for $115 to be

remitted to the exchange through the broker. The exchange will then

arrange for this amount to be passed on to the party on the other side of

the transaction.

In our example the investor has obtained at a cost of $115 the right to

buy 100 Intel shares for $22.50 each. The party on the other side of the

transaction has received $115 and has agreed to sell 100 Intel shares for

$22.50 per share if the investor chooses to exercise the option. If the price of

Intel does not rise above $22.50 before October 18, 2003, the option is not

exercised and the investor loses $115. But if the Intel share price does well

and the option is exercised when it is $30, the investor can buy 100 shares at

$22.50 per share when they are worth $30 per share. This leads to a gain of

$750, or $635 when the initial cost of the options is taken into account.

An alternative trade for the investor would be the purchase of one July

put option contract with a strike price of $20. From Table 2.6 we see that

this would cost 100 x 0.85 or $85. The investor would obtain at a cost of

$85 the right to sell 100 Intel shares for $20 per share prior to July 19,2003.

If the Intel share price stays above $20 the option is not exercised and the

42 Chapter 2

Profit ($)

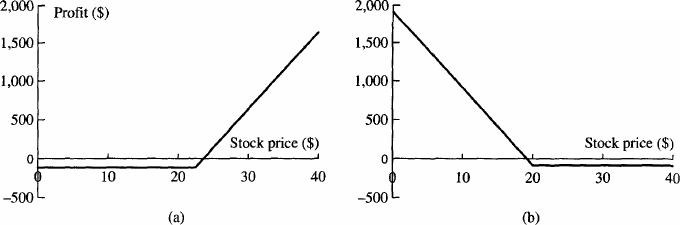

Figure 2.3 Net profit per share from (a) purchasing a contract consisting of 100

Intel October call options with a strike price of $22.50 and (b) purchasing a

contract consisting of 100 Intel July put options with a strike price of $20.00.

investor loses $85. But if the investor exercises when the stock price is $15,

the investor makes a gain of $500 by buying 100 Intel shares at $15 and

selling them for $20. The net profit after the cost of the options is taken into

account is $415.

The options trading on the CBOE are American. If we assume for

simplicity that they are European so that they can be exercised only at

maturity, the investor's profit as a function of the final stock price for the

Intel options we have been considering is shown in Figure 2.3.

There are four types of trades in options markets:

1. Buying a call

2. Selling a call

3. Buying a put

4. Selling a put

Buyers are referred to as having long positions; sellers are referred to as

having short positions. Selling an option is also known as writing the

option.

Options trade very actively in the over-the-counter market as well as on

exchanges. Indeed the over-the-counter market for options is now larger

than the exchange-traded market. Whereas exchange-traded options tend

to be American, options trading in the over-the-counter market are

frequently European. The advantage of the over-the-counter market is

that maturity dates, strike prices, and contract sizes can be tailored to

meet the precise needs of a client. They do not have to correspond to

those specified by the exchange. Option trades in the over-the-counter

market are usually much larger than those on exchanges.

Financial Products and How They Are Used for Hedging 43

Valuation formulas and numerical procedures for options on stocks,

stock indices, currencies, and futures are in Appendices C and D at the

end of this book.

2.4 USING THE PRODUCTS FOR HEDGING

Futures and forward contracts provide a hedge for an exposure at one

particular time. As we saw earlier the treasurer of a US company can use

the quotes in Table 2.3 to buy sterling forward when it is known that the

company will have to pay sterling at a certain future time. Similarly, the

treasurer can use the quotes to sell sterling forward when it is known that

it will receive sterling at a certain future time. Futures contracts can be

used in a similar way. When a futures contract is used for hedging the

plan is usually to close the contract out prior to maturity. As a result the

hedge performance is reduced somewhat because there is uncertainty

about the difference between the futures price and the spot price on the

close-out date. This uncertainty is known as basis risk.

When forward and futures contracts are used for hedging the objective

is to lock in the price at which an asset will be bought or sold at a certain

future time. The hedge ratio is the ratio of the size of the futures or

forward position to the size of the exposure. Up to now we have assumed

that a company uses a hedge ratio of 1.0. (For example, if it has a

$1 million exposure to the USD/GBP exchange rate it takes a $1 million

forward or futures position.) Sometimes a company may choose to

partially hedge its risks by using a hedge ratio of less than 1.0.

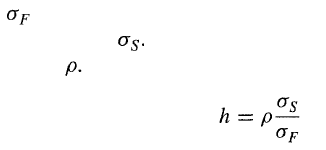

Even when a company wants to minimize its risks, it may not be

optimal for it to use a hedge ratio of 1.0. Suppose that the standard

deviation of the change in a futures or forward price during the hedging

period is and the standard deviation of the change in the value of the

asset being hedged is Suppose further that the correlation between the

two changes is It can be shown that the optimal hedge ratio is

(2.1)

Example 2.2

An airline expects to purchase 2.4 million gallons of jet fuel in one month's

time. Because there is no futures contract on jet fuel it decides to use the

futures contact on heating oil that trades on the New York Mercantile

Exchange. The correlation between monthly changes in the price of jet fuel

and monthly changes in heating oil futures price is 0.7. The standard deviation

44

Chapter 2

of monthly changes in the heating oil futures price per gallon is 0.024 and the

standard deviation of the monthly changes in the price of jet oil per gallon is

0.021. The optimal hedge ratio is therefore

Each heating oil futures contract is on 42,000 gallons of heating oil. The

number of contracts the company should buy is therefore

Example 2.3

A fund manager wants to hedge a well-diversified investment portfolio worth

$2.5 million until time T using a forward contracts on the S&P 500. The index

is currently 1250, so that the portfolio is worth 2000 times the index. Assume

that F is the current forward rate for a contract maturing at time T. If the

portfolio has a beta of 1.0, the hedge ratio should be 1.0 (see Section 1.1 for a

discussion of beta). This means that the forward contract should be structured

so that the payoff to the fund manager at time T is

2000(F - S

T

)

where S

T

is the value of the S&P 500 at time T. When = 2, the hedge

position should be doubled, so that the payoff is

4000(F - S

T

)

In general, the hedge ratio should equal the beta of the well-diversified

portfolio, so that the payoff from the forward contract is This

is consistent with equation (2.1) because it is approximately true that

and = 1.

As explained earlier, a swap can be regarded as a convenient way of

bundling forward contracts. It can provide a hedge for cash flows that will

occur on a regular basis over a period of time.

Options are a different type of hedging instrument from forwards,

futures, and swaps. Whereas forward, futures, and swap contracts lock

in prices for future sales or purchases of an asset, an option provides

insurance. For example, the call option in Figure 2.3a could be used to

guarantee that shares of Intel could be purchased for $22.50 or less in

October; the put option in Figure 2.3b could be used to guarantee that a

holding of shares in Intel could be sold for at least $20 in July.

A Practical Issue

It is important to realize that hedging can result in a decrease or an

increase in a company's profits relative to the position it would be in with

Financial Products and How They Are Used for Hedging 45

no hedging. Consider a company that decides to use a short futures

position to hedge the future sale of 1 million barrels of oil. If the price

of oil goes down, the company loses money on the sale of the oil and the

futures position leads to an offsetting gain. The treasurer can be con-

gratulated for having had the foresight to put the hedge in place. Clearly,

the company is better off than it would be with no hedging. Other

executives in the organization, it is hoped, will appreciate the contribution

made by the treasurer.

If the price of oil goes up, the company gains from its sale of the oil,

and the futures position leads to an offsetting loss. The company is in a

worse position than it would be with no hedging. Although the hedging

decision was perfectly logical, the treasurer may in practice have a difficult

time justifying it. Suppose that the price of oil increases by $3, so that the

company loses about $3 per barrel on the futures contract. We can

imagine a conversation such as the following between the treasurer and

the president:

PRESIDENT: This is terrible. We've lost $3 million in the futures

market in the space of three months. How could it

happen? I want a full explanation.

TREASURER: The purpose of the futures contracts was to hedge our

exposure to the price of oil—not to make a profit. Don't

forget that we made about $3 million from the favorable

effect of the oil price increases on our business.

PRESIDENT: What's that got to do with it? That's like saying that we

do not need to worry when our sales are down in

California because they are up in New York.

TREASURER : If the price of oil had gone down...

PRESIDENT : I don't care what would have happened if the price of oil

had gone down. The fact is that it went up. I really do not

know what you were doing playing the futures markets

like this. Our shareholders will expect us to have done

particularly well this quarter. I'm going to have to

explain to them that your actions reduced profits by

$3 million. I'm afraid this is going to mean no bonus

for you this year.

TREASURER: That's unfair. I was only...

PRESIDENT : Unfair! You are lucky not to be fired. You lost $3 million.

TREASURER : It all depends how you look at it...

46

Chapter 2

This shows that, although hedging reduces risk for the company, it can

increase risk for the treasurer if others do not fully understand what is

being done. The only real solution to this problem is to ensure that all

senior executives within the organization fully understand the nature of

hedging before a hedging program is put in place. One of the reasons why

treasurers sometimes choose to buy insurance using options rather than

implementing a more straightforward hedge using forwards, futures, or

swaps is that options do not lead to the problem we have just mentioned.

They allow the company to benefit from favorable outcomes while being

hedged against unfavorable outcomes. (Of course, this is achieved at a

cost. The company has to pay the option premium.)

2.5 EXOTIC OPTIONS AND STRUCTURED DEALS

We met one exotic swap transaction in Business Snapshot 2.2. Many

different types of exotic options and highly structured deals trade in the

over-the-counter market. Although exotics are a relatively small part of

the trading for a financial institution they are important because the profit

margin on trades in exotics tends to be much higher than on plain vanilla

options or swaps. Here are a few examples of exotic options:

Asian Options: Whereas regular options provide a payoff based on the

final price of the underlying asset at the time of exercise, Asian options

provide a payoff based on the average of the price of the underlying asset

over some specified period. An example is an average price call option that

provides a payoff in one year equal to max(S - K, 0), where S is the

average asset price during the year and K is the strike price.

Barrier Options: These options come into existence or disappear when the

price of the underlying asset reaches a certain barrier. For example, a

knock-out call option with a strike price of $30 and a barrier of $20 is a

regular call option that ceases to exist if the asset price falls below $20.

Basket Options: These are options on a portfolio of assets rather than

options on a single asset.

Binary Options: These are options that provide a fixed dollar payoff if

some criterion is met. An example is an option that provides a payoff in

one year of $1,000 if a stock price is greater than $20.

Compound Options: These are options on options. There are four types: a

call on a call, a call on a put, a put on a call, and a put on a put. An example

of a compound option is an option to buy an option on a stock currently

Financial Products and How They Are Used for Hedging 47

worth $15. The first option expires in one year and has a strike price of $1.

The second option expires in three years and has a strike price of $20.

Lookback Options: These are options that provide a payoff based on the

maximum or minimum price of the underlying asset over some period.

An example is an option that provides a payoff in one year equal to

S

T

- S

min

, where S

T

is the asset price at the end of the year and S

min

is the

minimum asset price during the year.

Business Snapshot 2.3 Microsoft's Hedging

Microsoft actively manages its foreign exchange exposure. In some countries

(e.g., Europe. Japan, and Australia) it bills in the local currency and converts

jits net revenue to US dollars monthly. For these currencies there is a clear

exposure to exchange rate movements. In other countries (e.g., Latin America,

Eastern Europe. and Southeast Asia) it bills in US dollars. The latter appears

to avoid any foreign exchange exposure - but it does not.

Suppose the US dollar strengthens against the currency of a country where

Microsoft is billing in dollars. People in the country will find it more difficult

to buy Microsoft products because it takes more of the local currency to buy

11. As a result Microsoft will probably find it necessary to reduce its US dollar

prices or face a decline in sales. Microsoft therefore has a foreign exchange

exposure—both when it bills in US dollars and when it bills in the local

currency. This emphasizes the point made in Section 2.2 that it is important to

consider the big picture when hedging.

Microsoft likes to use options for hedging. Suppose it uses a one-year time

horizon. Microsoft recognizes that its exposure to. say, the Japanese yen is an

exposure to the average exchange rate during the year because approximately

the same amount of yen is converted to US dollars each month. It therefore uses

Asian options rather than regular options to hedge the exposure. What is more,

Microsoft's net exposure is to a weighted average of the exchange rates for all

the countries in which it does business. It therefore uses basket options (i.e.,

options on a weighted average of exchange rates). A contract it likes to negotiate

with financial institutions is therefore an Asian basket put option. This cost of

this option is much less than a portfolio of put options, one for each month and

each exchange rate (see Problem 2.24). But it gives Microsoft exactly the

protection it requires.

Microsoft faces other financial risks. For example, it is exposed to interest

rate risk on its bond portfolio. (When rates rise, the portfolio loses money.) It

also has two sorts of exposure to equity prices. It is exposed to the equity

prices of the companies in which it invests. It is also exposed to its own equity

price because it regularly repurchases its own shares as part of its stock awards

program. It likes to use sophisticated option strategies to hedge these risks.

48

Chapter 2

Why do companies use exotic options and structured products in

preference to the plain vanilla products we looked at in Section 2.3?

Sometimes the products are totally inappropriate as risk management

tools. (This was certainly true in the case of the Procter and Gamble

swap discussed in Business Snapshot 2.2.) But usually there are sound

reasons for the contracts entered into by corporate treasurers. For

example, Microsoft often uses Asian basket options in its risk manage-

ment. As explained in Business Snapshot 2.3 this is the ideal product for

managing its exposures.

2.6 DANGERS

Derivatives are very versatile instruments. They can be used for hedging,

for speculation, and for arbitrage. (Hedging involves reducing risks;

speculation involves taking risks; arbitrage involves locking in a profit

by simultaneously trading in two or more markets.) It is this very

versatility that can cause problems. Sometimes traders who have a

mandate to hedge risks or follow an arbitrage strategy become (con-

sciously or unconsciously) speculators. The results can be disastrous.

One example of this is provided by the activities of Nick Leeson at

Barings Bank (see Business Snapshot 2.4).

6

To avoid the problems Barings encountered, it is very important for

both financial and nonfinancial corporations to set up controls to ensure

that derivatives are being used for their intended purpose. Risk limits

should be set and the activities of traders monitored daily to ensure that

the risk limits are adhered to.

SUMMARY

There are two types of markets in which financial products trade: the

exchange-traded market and the over-the-counter market. In this chapter

we have reviewed spot trades, forward contracts, futures contracts, swaps,

and options contracts. A forward or futures contract involves an obliga-

tion to buy or sell an asset at a certain time in the future for a certain

price. A swap is an agreement to exchange cash flows in the future in

amounts dependent on the values of one or more market variables. There

are two types of options: calls and puts. A call option gives the holder the

6

The movie Rogue Trader provides a good dramatization of the failure of Barings Bank.

Financial Products and How They Are Used for Hedging 49

right to buy an asset by a certain date for a certain price. A put option

gives the holder the right to sell an asset by a certain date for a certain

price. Forwards, futures, swaps, and options trade on a wide range of

different underlying assets.

Forward, futures, and swap contracts have the effect of locking in the

prices that will apply to future transactions. Options by contrast provide

insurance. They ensure that the price applicable to a future transaction

will not be worse than a certain level. Exotic options and structured

products are tailored to the particular needs of corporate treasurers.

For example, as we saw in Business Snapshot 2.3, Asian basket options

can allow a company such as Microsoft to hedge its net exposure to

several risks over a period of time.

It is important to look at the big picture when hedging. For example,

a company may find that it is increasing rather than reducing its risks if

it chooses to hedge when none of its competitors does so. The hedge

ratio is the ratio of the size of the hedge position to the size of the

exposure. It is not always optimal to use a hedge ratio of 1.0. The

optimal hedge ratio depends on the variability of futures price, the

variability of the price of the asset being hedged, and the correlation

between the two.

Business Snapshot 2.4 The Barings Bank Disaster

Derivatives are very versatile instruments. They can be used for hedging,

speculation, and arbitrage. One of the risks faced by a company that trades

derivatives is that an employee who has a mandate to hedge or to look for

arbitrage opportunities may become a speculator.

Nick Leeson, an employee of Barings Bank in the Singapore office in 1995.

had a mandate to look for arbitrage opportunities between the Nikkei 225

futures prices on the Singapore exchange and the Osaka exchange. Over time

Leeson moved from being an arbitrageur to being a speculator without anyone

in Barings head office in London fully understanding that he had changed the

way he was using derivatives. He began to make losses, which he was able to

hide. He then began to take bigger speculative positions in an attempt to

recover the losses, but only succeeded in making the losses worse.

In the end Leeson's total loss was close to 1 billion dollars. As a result.

Barings a bank that had been in existence for 200 years -was wiped out.

One of the lessons from the Barings disaster is that it is important to define

unambiguous risk limits for traders and then carefully monitor their activities

to make sure that the limits are adhered to.

50

Chapter 2

FURTHER READING

Baz, J., and M. Pascutti. "Alternative Swap Contracts Analysis and Pricing,"

Journal of Derivatives, Winter 1996: 7-21.

Boyle, P., and F. Boyle, Derivatives: The Tools That Changed Finance. London:

Risk Books, 2001

Brown, K. C. and D. J. Smith. Interest Rate and Currency Swaps: A Tutorial.

Association for Investment Management and Research, 1996.

Brown, G. W. "Managing Foreign Exchange Risk with Derivatives." Journal of

Financial Economics, 60 (2001): 401-448.

Flavell, R. Swaps and Other Instruments. Chichester: Wiley, 2002.

Geczy, C, B.A. Minton, and C. Schrand. "Why Firms Use Currency

Derivatives," Journal of Finance, 52, No. 4 (1997): 1323-1354.

Litzenberger, R. H. "Swaps: Plain and Fanciful," Journal of Finance, 47, No. 3

(1992): 831-850.

Miller, M. H. "Financial Innovation: Achievements and Prospects," Journal of

Applied Corporate Finance, 4 (Winter 1992): 4-11.

Warwick B., F. J. Jones, and R. J. Teweles. The Futures Game, 3rd edn. New

York: McGraw-Hill, 1998.

QUESTIONS AND PROBLEMS (Answers at End of Book)

2.1. What is the difference between a long forward position and a short

forward position?

2.2. Explain the difference between hedging, speculation, and arbitrage.

2.3. What is the difference between entering into a long forward contract when

the forward price is $50 and taking a long position in a call option with a

strike price of $50?

2.4. Explain carefully the difference between selling a call option and buying a

put option.

2.5. An investor enters into a short forward contract to sell 100,000 British

pounds for US dollars at an exchange rate of 1.5000 US dollars per

pound. How much does the investor gain or lose if the exchange rate at

the end of the contract is (a) 1.4900 and (b) 1.5200?

2.6. A trader enters into a short cotton futures contract when the futures price

is 50 cents per pound. The contract is for the delivery of 50,000 pounds.

How much does the trader gain or lose if the cotton price at the end of the

contract is (a) 48.20 cents per pound and (b) 51.30 cents per pound?